Amid High Inflation in a much-anticipated move, the Reserve Bank of India (RBI) has decided to maintain the repo rate at 6.5%, signaling a cautious stance amid persistent inflation and global economic uncertainties. The decision, announced following the Monetary Policy Committee (MPC) meeting, comes in the wake of mounting pressures on consumer spending, elevated inflation levels, and signs of a slowdown in growth momentum. While the MPC’s approach reflects its commitment to achieving economic stability, it has also downgraded growth and inflation projections for the fiscal year 2024-25, underscoring the challenges ahead.

The MPC’s Rationale

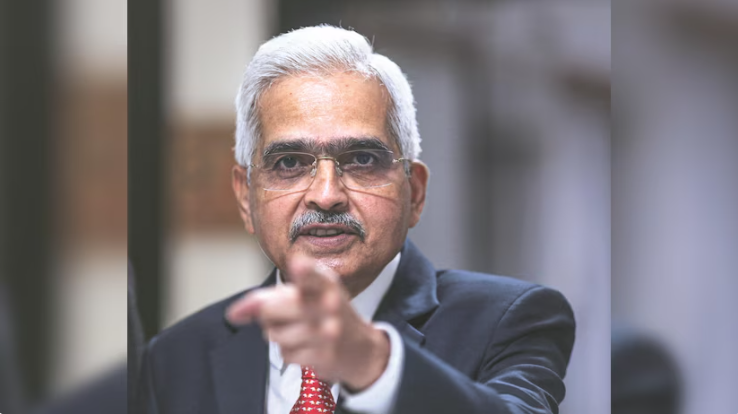

RBI Governor Shaktikanta Das emphasized that the decision to keep the repo rate unchanged stems from the need to strike a balance between controlling inflation and fostering economic growth. “Persistent inflation has reduced the disposable income of consumers and dented consumption,” Das stated, acknowledging the toll that rising prices have taken on household finances and overall demand.

The repo rate—the rate at which the RBI lends to commercial banks—has remained at 6.5% since February 2023. This steady rate, according to the MPC, is crucial to sustaining a calibrated approach to monetary policy as external and domestic headwinds challenge economic stability.

Inflationary Pressures

India has witnessed elevated retail inflation in recent months, largely driven by supply chain disruptions, rising food prices, and global geopolitical uncertainties. The MPC’s revised inflation projection for 2024-25 stands at 4.8%, up from earlier estimates. While this remains within the RBI’s medium-term target of 4%, it reflects the persistent risks that could derail price stability.

Factors contributing to inflation include:

- Volatile Food Prices: Unseasonal rains and erratic monsoons have disrupted agricultural output, causing spikes in vegetable and cereal prices.

- Global Oil Prices: The recent uptick in crude oil prices has increased transportation and manufacturing costs.

- Supply Chain Bottlenecks: Ongoing geopolitical tensions and global trade imbalances have exacerbated supply-side constraints.

Slower Growth Momentum

The MPC also downgraded India’s GDP growth projection for 2024-25 to 6.6%, a marginal decline from earlier expectations. The committee noted signs of a slowdown in growth momentum, attributing it to weaker exports, sluggish private investment, and reduced consumption demand. While India remains one of the fastest-growing major economies globally, these challenges highlight vulnerabilities that need addressing.

Impact on Consumers and Businesses

The decision to hold the repo rate steady has mixed implications for consumers and businesses.

For Consumers

- Borrowing Costs: The unchanged repo rate ensures that home loans, personal loans, Amid High Inflationand other borrowing costs remain steady, providing relief to borrowers who were bracing for potential hikes.

- Reduced Purchasing Power: Persistent inflation continues to erode household purchasing power, forcing many to cut back on discretionary spending.

- Savings and Investments: Fixed deposit rates, Amid High Inflation which are linked to the repo rate, are likely to remain stable, benefiting conservative investors but offering limited returns amid high inflation.

For Businesses

- Cost of Capital: With borrowing costs unchanged, businesses, Amid High Inflation especially in sectors like manufacturing and real estate, can continue to access affordable credit to fund expansion and operations.

- Demand Challenges: Weak consumption demand poses a hurdle for revenue growth across industries, particularly consumer goods and retail.

- Input Costs: Elevated input costs due to inflation and global factors could pressure profit margins.

RBI’s Measures to Tame Inflation

The central bank has adopted a multipronged strategy to address inflation while supporting economic growth. Key measures include:

- Targeted Liquidity Management: The RBI is closely monitoring liquidity in the banking system to ensure adequate credit flow while avoiding excess money supply that could fuel inflation.

- Intervention in Food Supply: Collaborating with the government, Amid High Inflation the RBI is advocating for measures to stabilize food prices through imports, stock releases, and incentives for farmers.

- Exchange Rate Stability: Managing the rupee’s volatility against the dollar is crucial to mitigating imported inflation.

Global Context and Challenges

India’s monetary policy decisions are not isolated from global economic dynamics. Central banks worldwide, including the Federal Reserve and the European Central Bank, have been navigating high inflation and slowing growth, often with aggressive rate hikes. While India has opted for a more measured approach, external challenges such as fluctuating commodity prices, geopolitical conflicts, Amid High Inflation and trade disruptions remain significant risks.

Comparison with Peers

- United States: The Federal Reserve has implemented successive rate hikes to combat inflation, albeit at the cost of economic growth.

- Eurozone: The European Central Bank faces a similar dilemma, Amid High Inflation balancing inflation control with recession fears.

- Emerging Markets: Countries like Brazil and South Africa are grappling with currency depreciation and capital outflows, adding layers of complexity to their monetary policies.

The Road Ahead

As India navigates this challenging economic landscape, the RBI’s decisions will hinge on evolving data and conditions. Here are potential scenarios:

1. Inflation Easing

Should inflationary pressures subside—driven by improved supply chains, favorable monsoons, Amid High Inflation or reduced global commodity prices—the RBI could consider rate cuts to stimulate growth.

2. Prolonged Inflation

If inflation remains sticky, the central bank may be forced to tighten monetary policy further, Amid High Inflation potentially impacting growth.

3. Growth Recovery

Structural reforms, increased public spending, and export growth could bolster economic momentum, Amid High Inflation creating room for more accommodative monetary policy.

4. External Shocks

Geopolitical crises or sharp fluctuations in global markets could necessitate swift interventions to stabilize the economy.

Conclusion

The RBI’s decision to keep the repo rate unchanged at 6.5% reflects its cautious approach in a complex economic environment. While persistent inflation and slowing growth pose significant challenges, Amid High Inflation the central bank’s focus on balancing these priorities underscores its commitment to long-term stability.

For policymakers, businesses, and households alike, the path forward will require adaptability, resilience, and a shared focus on sustainable economic progress. As Governor Das aptly remarked, Amid High Inflation navigating this phase demands “a steady hand on the wheel,” ensuring India’s economy remains robust and resilient amid global headwinds. ALSO READ:- Congo on High Alert as Mystery Flu-Like Disease Claims 71 Lives 2024

windshield replacement 29303

mobile auto glass 29305

windshield installer 29301

rear windshield replacement 29305

windshield repair special 29303

This made me feel so motivated — thank you!

Amazing job — I’ll be sharing this with others.