1. Sensex Introduction: A Rough Week for Indian Markets

Indian markets have Sensex faced a turbulent period, with the Sensex plummeting to a two-and-a-half-month low, dipping below the significant 80,000 mark. The downturn has affected nearly all sectors, with Mid and Smallcap stocks hit particularly hard. A blend of internal and external pressures, including foreign investor sell-offs, underwhelming corporate Q2 results, and climbing U.S. Treasury yields, have compounded to create a challenging scenario for investors. This article delves into the reasons behind the slump, the sectors impacted most, and the implications for India’s economy and investment outlook.

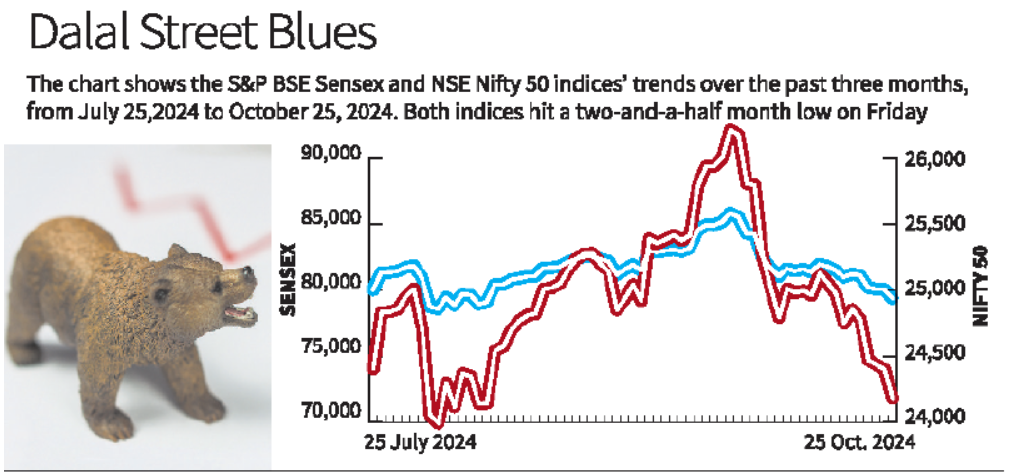

2. Overview of the Market Crash: The Downtrend in Indian Indices

Throughout this week, Indian indices such as the BSE Sensex and NSE Nifty have experienced sustained pressure. Every trading session this week has seen a decline, leading to a cumulative drop that has brought the Sensex below 80,000. Mid and Smallcap stocks have seen the steepest falls, reflecting an overall dip in investor confidence across the board.

Key Market Performance Indicators: The Sensex and Nifty, India’s primary stock indices, serve as barometers of the broader economy. As they drop, it sends a strong signal about market sentiment and economic expectations.

Foreign Institutional Investors (FIIs) Sell-Off: FIIs play a significant role in Indian markets, and their withdrawal signals concerns about India’s current and future growth prospects, often influenced by external factors like global economic trends and political stability.

3. Foreign Investors and Rising U.S. Treasury Yields

One of the primary factors contributing to the Sensex’s sharp decline is the exit of foreign investors, who are moving funds to markets with more stable returns. Rising U.S. Treasury yields have made American bonds more attractive, drawing away investments from emerging markets like India.

Impact of U.S. Treasury Yields: The Sensex U.S. Federal Reserve’s recent hikes in interest rates have made Treasury bonds a lucrative option for investors seeking stable returns. Sensex With yields rising, investors are reallocating their portfolios away from high-risk assets, such as emerging market equities, towards safer investments in the U.S.

Currency Volatility: A shift of funds towards the U.S. also has a depreciative effect on the Indian Rupee, adding to the pressures on India’s economy. As the Rupee Sensex weakens, the cost of imports increases, putting further stress on sectors dependent on imported raw materials and energy.

4. Corporate Earnings Disappoint in Q2

Weak Q2 earnings from a range of companies have further fueled the market’s downward trajectory. Earnings reports revealed that several large corporations fell short of market expectations, with factors such as rising costs, regulatory hurdles, and slowing demand weighing down profits.

Sector-Specific Performance:

Automobile Sector: While some automotive Sensex companies had anticipated growth, high input costs and supply chain disruptions have resulted in lackluster earnings.

IT Sector: The IT sector, usually a stalwart performer, showed signs of slowing down due to lower global demand and clients cutting back on IT budgets.

Banking and Financial Services: The rising interest rate environment has created mixed results, with loan disbursements slowing down and concerns about asset quality.

5. Impact on Mid and Smallcap Stocks

While large-cap stocks have borne Sensex the brunt of the sell-off, mid and small-cap stocks have seen even steeper declines, reflecting their heightened vulnerability to market volatility. These stocks, typically more volatile than their large-cap counterparts, are the first to be hit during periods of market uncertainty.

Investor Sentiment in Mid and Smallcaps: The Sensex bearish sentiment has led to widespread panic-selling in mid and small-cap stocks, exacerbating the market’s decline. These stocks are popular among retail investors who often have a lower risk tolerance, resulting in an intensified sell-off as panic spreads.

Liquidity Concerns: Sensex With reduced liquidity in these segments, mid and small-cap stocks are facing even more pressure as investors find it difficult to exit positions without incurring significant losses.

6. Sectoral Analysis: Winners and Losers

The decline in the market has not impacted all sectors equally. While some sectors have shown relative resilience, others have struggled significantly:

Energy and Utility Stocks: These Sensex sectors have been somewhat insulated due to consistent demand, although the impact of rising costs and regulatory challenges still looms.

Healthcare and Pharmaceuticals: The healthcare sector, often considered a defensive play, has shown moderate stability. However, regulatory pressures and export challenges have affected some of the bigger pharmaceutical companies.

Technology and Financial Services: High-growth sectors like IT and financial services, traditionally strong performers in Indian markets, have been hit hard due to external pressures and declining demand in overseas markets.

7. Domestic Factors Exacerbating the Sell-Off

While global factors have played a significant role in driving down the market, domestic issues have compounded the problem. Rising inflation, currency depreciation, and political uncertainty have all contributed to a loss of confidence among investors.

Inflation and Interest Rates: Inflationary pressures in India, driven by higher costs of imported goods, have led to speculation that the Reserve Bank of India (RBI) may raise interest rates. A hike would put further pressure on borrowing costs, affecting both consumers and businesses.

Political Uncertainty: With general elections approaching, concerns around policy changes and economic reform have led to a cautious approach by institutional investors.

8. Implications for Retail Investors

The market downturn has had a particularly significant impact on retail investors, many of whom had entered the market during the recent bull run. The current scenario has led to substantial portfolio losses, especially for those invested in mid and small-cap stocks.

Risk of Panic Selling: Retail investors, often more susceptible to market sentiment, are at risk of selling off assets at a loss due to panic.

Investment Strategy Shifts: With the market outlook uncertain, financial advisors are encouraging retail investors to adopt a long-term perspective and avoid making impulsive decisions.

9. Government and Regulatory Responses

In light of the market turmoil, the government and regulatory bodies like the RBI are under pressure to implement measures to stabilize the economy and restore investor confidence.

Monetary Policy Adjustments: The RBI may consider adjusting its policy stance to support economic growth, though it is cautious of the inflationary impact of such moves.

Stimulus Measures: There are calls for the government to introduce stimulus packages or tax incentives to provide a cushion for key sectors, especially those most affected by the downturn.

10. Future Outlook and Recovery Prospects

While the current market scenario is undoubtedly challenging, some analysts see potential for recovery in the medium term. Factors that could contribute to a rebound include:

Stabilization of Global Markets: If the U.S. and other major economies manage to control inflation and stabilize growth, it could lead to renewed interest in emerging markets.

Improvement in Corporate Earnings: If Indian companies can weather the current economic conditions and demonstrate stronger Q3 earnings, it may help restore confidence.

Increased Domestic Investment: With foreign investments declining, there is an opportunity for domestic investors to step in and support the market. Initiatives to encourage domestic investment could provide the market with much-needed stability.

11. Long-Term Investment Strategies in Bear Markets

For long-term investors, bear markets often present opportunities to buy quality stocks at lower prices. Financial experts suggest focusing on blue-chip stocks and sectors with strong growth potential, such as renewable energy, healthcare, and technology.

Portfolio Diversification: To mitigate risk, diversification across different sectors and asset classes is essential. Investors are advised to balance their portfolios to include both growth-oriented and defensive stocks.

Systematic Investment Plans (SIPs): SIPs are gaining popularity as a way to invest gradually, reducing the impact of volatility. They allow investors to accumulate shares over time, thereby averaging out costs.

12. Conclusion: Navigating the Market Uncertainty

The current market environment reflects a combination of global and domestic challenges that have led to a significant decline in the Sensex and broader Indian indices. While the short-term outlook remains uncertain, the resilience of the Indian economy and the strength of key sectors offer hope for recovery. Investors are advised to take a cautious approach, focusing on long-term gains and avoiding impulsive decisions driven by market fluctuations.

As India navigates this period of economic uncertainty, the lessons learned may ultimately strengthen its financial markets and economy, positioning it for future growth. Despite the immediate challenges, those who remain disciplined and patient stand to benefit when the markets eventually stabilize. ALSO READ:- “Morkel Says the Lack of a Partnership Cost India Dear: Analyzing India’s Performance and Future Strategies” 2024

Эта информационная статья охватывает широкий спектр актуальных тем и вопросов. Мы стремимся осветить ключевые факты и события с ясностью и простотой, чтобы каждый читатель мог извлечь из нее полезные знания и полезные инсайты.

Узнать больше – https://quick-vyvod-iz-zapoya-1.ru/