1. Introduction

India Cannot Risk global economy continues to navigate the turbulent waters of post-pandemic recovery, inflation remains a critical concern for nations worldwide. In India, the specter of rising prices has prompted serious discussions among policymakers, economists, India Cannot Risk and financial institutions. Recently, Reserve Bank of India (RBI) Governor Shaktikanta Das emphasized the need for vigilance against inflationary pressures, asserting that India cannot afford another bout of inflation. This article delves into the implications of his statements, the current economic landscape, and the measures required to ensure stable prices in the country.

2. Understanding Inflation

2.1. What is Inflation?

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured by the Consumer Price Index (CPI) or the Wholesale Price Index (WPI). A moderate level of inflation is often seen as a sign of a growing economy, but high inflation can lead to significant economic challenges.

2.2. Causes of Inflation

Several factors contribute to inflation, including:

- Demand-Pull Inflation: Occurs when demand for goods and services exceeds supply.

- Cost-Push Inflation: Results from rising production costs, India Cannot Risk leading producers to pass on these costs to consumers.

- Built-In Inflation: Linked to adaptive expectations, where businesses and workers expect rising prices and wages.

3. Current Economic Landscape in India

3.1. Post-Pandemic Recovery

India’s economy has been on a recovery path since the disruptions caused by the COVID-19 pandemic. However, this recovery has been uneven, India Cannot Risk with certain sectors rebounding more quickly than others. The ongoing geopolitical tensions, fluctuations in global oil prices, and supply chain disruptions have further complicated the recovery process.  For the more information click on this link

For the more information click on this link

3.2. Recent Inflation Trends

In recent months, India has witnessed fluctuations in inflation rates, driven by factors such as:

- Rising Fuel Prices: Increased global oil prices have significantly impacted transportation costs and, consequently, the prices of essential goods.

- Food Prices: Seasonal variations and supply chain issues have led to spikes in food prices, India Cannot Risk a significant contributor to overall inflation.

- Monetary Policy Response: The RBI has implemented various monetary policy measures to address inflation, including interest rate adjustments and liquidity management.

4. The Governor’s Perspective

4.1. Statements by Shaktikanta Das

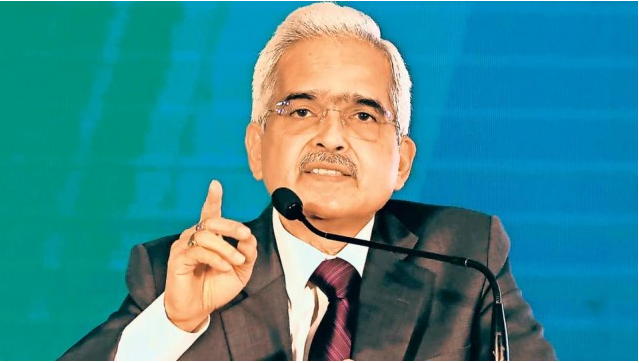

RBI Governor Shaktikanta Das has been vocal about the challenges posed by inflation. In a recent address, he highlighted:

- Need for Vigilance: Das stressed that the central bank must remain vigilant against inflationary pressures, particularly in the context of rising global commodity prices and their impact on domestic markets.

- Economic Stability: The Governor emphasized that maintaining economic stability is crucial for sustainable growth, and inflation poses a significant risk to this stability.

4.2. Implications of Inflation

High inflation can have several adverse effects on the economy, including:

- Reduced Purchasing Power: As prices rise, consumers can afford less, leading to decreased demand for goods and services.

- Increased Cost of Living: Inflation affects the cost of essential goods, India Cannot Risk leading to increased financial strain on households, India Cannot Risk particularly those with fixed incomes.

- Impact on Investments: Uncertainty about future inflation can deter both domestic and foreign investments, hampering economic growth.

5. Policy Measures to Combat Inflation

5.1. Monetary Policy Interventions

The RBI plays a pivotal role in managing inflation through its monetary policy framework. Key measures include:

- Interest Rate Adjustments: The RBI can raise interest rates to curb spending and investment, which can help bring down inflation.

- Liquidity Management: By controlling the money supply in the economy, India Cannot Risk the RBI can influence inflationary pressures.

5.2. Fiscal Policy Coordination

Coordination between monetary and fiscal policy is crucial in addressing inflation. The government can:

- Subsidize Essential Goods: Implement targeted subsidies to alleviate the burden of rising prices on vulnerable populations.

- Enhance Supply Chain Efficiency: Invest in infrastructure and logistics to improve the distribution of goods, India Cannot Risk thus reducing costs and mitigating inflation.

5.3. Strengthening Supply Chains

Strengthening domestic supply chains is vital to reducing cost-push inflation. This can involve:

- Investment in Local Production: Encouraging local manufacturing can help decrease dependence on imports, particularly for essential goods.

- Diversification of Suppliers: Reducing reliance on a limited number of suppliers can enhance resilience and stability in supply chains.

6. The Role of Technology in Inflation Management

6.1. Digital Payment Systems

The adoption of digital payment systems can enhance transaction efficiency and reduce costs for businesses and consumers. This can contribute to stabilizing prices in the economy.

6.2. Data Analytics

Utilizing data analytics can help businesses and policymakers make informed decisions about pricing, inventory management, India Cannot Risk and demand forecasting, thereby reducing inflationary pressures.

7. Public Awareness and Education

7.1. Financial Literacy Programs

Increasing financial literacy among consumers can empower them to make informed decisions about spending, saving, and investing. Educated consumers are better equipped to navigate inflationary environments.

7.2. Awareness Campaigns

Public awareness campaigns about the impacts of inflation can foster understanding and resilience among consumers, India Cannot Risk encouraging prudent financial behavior during periods of rising prices.  For the more information click on this link

For the more information click on this link

8. The Way Forward

8.1. Monitoring Global Trends

India must closely monitor global economic trends, particularly in commodity prices, as these can have a significant impact on domestic inflation. Proactive measures can help mitigate the effects of external shocks.

8.2. Continued Vigilance

Both the RBI and the government need to remain vigilant in monitoring inflation indicators and be prepared to take decisive action when necessary. This includes adjusting monetary policy and implementing targeted fiscal measures.

8.3. Fostering Sustainable Growth

Ultimately, the goal should be to foster sustainable economic growth while keeping inflation in check. This requires a balanced approach that considers the needs of consumers, businesses, and the overall economy.

9. Conclusion

As RBI Governor Shaktikanta Das rightly pointed out, India cannot risk another bout of inflation. The stakes are high, and the implications of unchecked inflation can be detrimental to the economy and the well-being of citizens. By adopting a comprehensive approach that combines monetary policy, fiscal measures, technological advancements, and public education, India can navigate the challenges posed by inflation. It is imperative that stakeholders remain vigilant and proactive in their efforts to ensure economic stability and foster sustainable growth in the face of evolving global dynamics. ALSO READ:-Bajaj Finserv Q2 Net Profit Grows 8% to ₹2,087 Crore: An Analysis of Financial Performance 2024