On the backdrop of rising global commodity prices and increased domestic demand, the National Mineral Development Corporation (NMDC), India’s largest iron ore producer, announced a hike of ₹400 per tonne in iron ore prices. This adjustment in prices comes at a critical time for the Indian mining and steel industry, which is grappling with supply chain disruptions, fluctuating raw material costs, and heightened demand for infrastructure development.

In this in-depth analysis, we will explore the factors that led NMDC to increase iron ore prices, the implications for various sectors of the economy, particularly the steel industry, and how this change fits into the broader economic and global trends. We will also examine the potential long-term effects on consumers, the Indian government’s policy response, and the global supply-demand dynamics that are reshaping the iron ore market.

1. Understanding NMDC and Its Role in the Indian Mining Sector

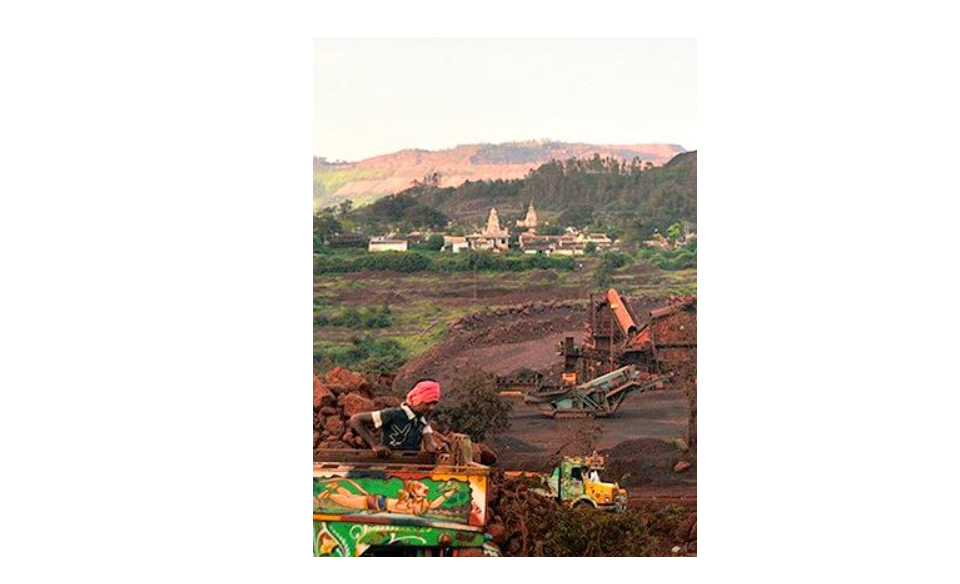

NMDC, a public sector enterprise under the Ministry of Steel, is India’s largest iron ore producer, with a significant presence in the domestic and international markets. It operates mines in Chhattisgarh and Karnataka and has been a critical supplier of raw materials to India’s steelmakers for decades. NMDC’s pricing decisions play a pivotal role in shaping the cost structures of downstream industries, especially steel production.

A. Importance of Iron Ore in the Steel Industry

Iron ore is the primary raw material used in steel production, accounting for a significant portion of the cost of manufacturing steel. India, being the second-largest steel producer in the world, relies heavily on domestic iron ore supplies, with NMDC being a major contributor. Therefore, any change in iron ore prices has a direct and immediate impact on steel manufacturers, construction companies, and ultimately, consumers.

B. NMDC’s Pricing Mechanism

NMDC revises iron ore prices regularly based on various factors such as domestic demand and supply, global market trends, and production costs. The company’s pricing decisions are crucial because they set the benchmark for the entire mining sector in India. NMDC’s recent price hike of ₹400 per tonne reflects the company’s response to evolving market conditions and its strategic objectives to remain competitive.

2. Reasons Behind the Price Hike

The decision by NMDC to raise iron ore prices by ₹400 per tonne was driven by a combination of domestic and international factors. Understanding these underlying causes is essential to assess the broader implications of this price adjustment.

A. Increased Demand for Steel in India

India’s steel demand has surged in recent years, driven by government-led infrastructure projects, urbanization, and industrial growth. The government’s focus on building new highways, railways, airports, and housing has created strong demand for steel, which, in turn, has pushed up the demand for iron ore. As steelmakers strive to keep up with this growing demand, their reliance on iron ore suppliers like NMDC has intensified, leading to price hikes.

B. Global Commodity Price Trends

Iron ore is a globally traded commodity, and its prices are influenced by international supply-demand dynamics. In the past few years, global iron ore prices have been volatile due to disruptions in major producing regions, particularly in Australia and Brazil, caused by natural disasters, labor strikes, and logistical challenges. This volatility has had a ripple effect on NMDC’s pricing decisions, as Indian prices tend to align with global market trends.

C. Rising Costs of Mining Operations

The cost of mining operations, including labor, energy, and transportation, has risen steadily in India. NMDC, like other mining companies, has had to cope with increasing operational costs. In addition, environmental regulations and compliance requirements have added to the cost burden, making it necessary for NMDC to adjust its prices to maintain profitability.

D. Iron Ore Supply Chain Disruptions

The COVID-19 pandemic caused significant disruptions to global supply chains, including the mining and steel sectors. While India has recovered relatively quickly, ongoing challenges such as port congestion, transportation bottlenecks, and delays in the supply of equipment have affected the availability of iron ore. These disruptions have created supply constraints that contribute to upward pressure on prices.

E. Export Opportunities and Global Demand

NMDC has been increasing its focus on export markets, where iron ore prices are often higher than in the domestic market. The strong demand for iron ore from countries like China, Japan, and South Korea has prompted NMDC to explore more export opportunities, which, in turn, has influenced domestic pricing decisions. As global demand continues to recover post-pandemic, NMDC is positioning itself to capitalize on these export opportunities while ensuring sufficient supplies for domestic steelmakers.

3. Impact on the Indian Steel Industry

The steel industry is one of the primary consumers of iron ore in India, and any change in the cost of raw materials has a direct impact on the production costs of steel. NMDC’s price hike of ₹400 per tonne is expected to have several immediate and long-term effects on the steel sector.

A. Increased Production Costs

Steel manufacturers are likely to see a rise in production costs as a result of the iron ore price hike. Iron ore constitutes a significant portion of the input costs for steel production, and any increase in its price puts pressure on the margins of steel companies. Large integrated steel players like Tata Steel, JSW Steel, and Steel Authority of India (SAIL) are expected to absorb some of these costs, but smaller steelmakers may face challenges in maintaining profitability.

B. Potential for Higher Steel Prices

To offset the higher cost of raw materials, steel producers may pass on the increased costs to consumers in the form of higher steel prices. This could lead to a rise in the cost of steel-based products, including construction materials, automobiles, and consumer goods. The increase in steel prices could have a cascading effect on the broader economy, particularly in sectors that are heavily reliant on steel.

C. Impact on Infrastructure Projects

India’s infrastructure sector, which is a major consumer of steel, could feel the effects of rising steel prices. Large infrastructure projects, such as roads, bridges, and housing, often operate on tight budgets, and any increase in raw material costs could lead to delays or cost overruns. The government may need to re-evaluate its spending on infrastructure projects to account for these higher costs.

D. Competitive Pressure in the Global Market

India’s steel exports have been on the rise, with the country becoming a key player in the global steel market. However, higher iron ore prices could erode the competitive advantage of Indian steelmakers in the international market, where they compete with producers from countries with lower input costs. This could affect India’s export volumes and reduce the profitability of steel manufacturers that rely on global markets.

4. Broader Economic Implications

The iron ore price hike by NMDC is not just an isolated event; it has broader implications for various sectors of the economy, including manufacturing, construction, and consumer goods. Here, we explore some of the key economic impacts of the price increase.

A. Inflationary Pressures

The increase in iron ore prices is expected to contribute to inflationary pressures in the economy, particularly in the construction and manufacturing sectors. As the cost of steel rises, prices for a wide range of goods and services could increase, leading to higher inflation. This, in turn, could affect consumer purchasing power and overall economic growth.

B. Government Policy Response

The Indian government may need to consider policy measures to address the impact of rising iron ore prices on the economy. This could include interventions to stabilize prices, such as reducing export duties on iron ore or providing subsidies to steel manufacturers. Additionally, the government may need to monitor the inflationary impact of the price hike and adjust monetary policies accordingly.

C. Impact on Employment

The iron ore price hike could have implications for employment in both the mining and steel sectors. While mining companies like NMDC may benefit from higher revenues, steel manufacturers facing higher input costs could be forced to cut jobs or reduce wages to maintain profitability. This could lead to job losses in the steel industry, particularly among smaller companies that are more vulnerable to cost increases.

5. Long-Term Outlook for the Iron Ore Market

The iron ore market is expected to remain volatile in the coming years, driven by a combination of global supply-demand dynamics, environmental regulations, and technological advancements. Here are some of the key trends that could shape the future of the iron ore market.

A. Shift Towards Green Steel

As the world moves towards more sustainable practices, the demand for green steel—steel produced using environmentally friendly methods—is expected to rise. This shift could impact the demand for traditional iron ore, particularly in countries that are adopting stricter environmental regulations. NMDC and other mining companies may need to adapt to this trend by exploring new technologies and production methods that align with the green steel movement.

B. Investment in New Mining Technologies

The mining industry is undergoing a technological transformation, with companies investing in automation, artificial intelligence, and other innovations to improve efficiency and reduce costs. NMDC’s ability to maintain its competitive edge in the global market will depend on its willingness to adopt these technologies and improve its operational efficiency.

C. Global Supply Chain Resilience

The COVID-19 pandemic exposed vulnerabilities in global supply chains, and companies are now looking for ways to build resilience against future disruptions. In the iron ore market, this could mean diversifying supply sources, investing in local production capacity, and reducing reliance on international markets. NMDC’s pricing decisions will need to consider these evolving supply chain dynamics as the global economy continues to recover.

6. Conclusion

NMDC’s decision to raise iron ore prices by ₹400 per tonne is a reflection of the complex interplay between domestic demand, global market trends, and operational challenges. While the price hike will provide a short-term boost to NMDC’s revenues, it also presents challenges for the Indian steel industry, which will need to navigate higher input costs and potential inflationary pressures.

The broader economic implications of this price increase underscore the need for a coordinated policy response from the government to ensure that the Indian economy remains resilient in the face of rising commodity prices. As the global iron ore market continues to evolve, NMDC’s ability to adapt to new technologies and market conditions will be critical to its long-term success.

In conclusion, NMDC’s price hike is a significant development that will have far-reaching consequences for India’s mining and steel industries, as well as the broader economy. How these industries respond to the changing market dynamics will shape the future trajectory of India’s economic growth.