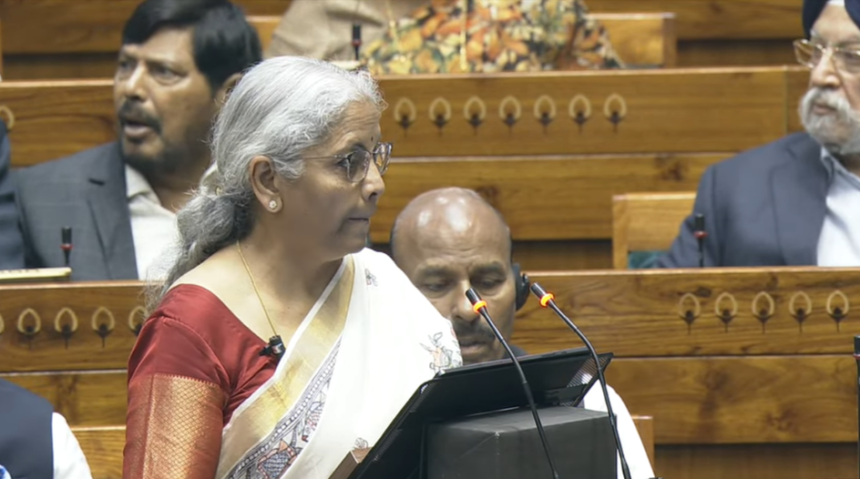

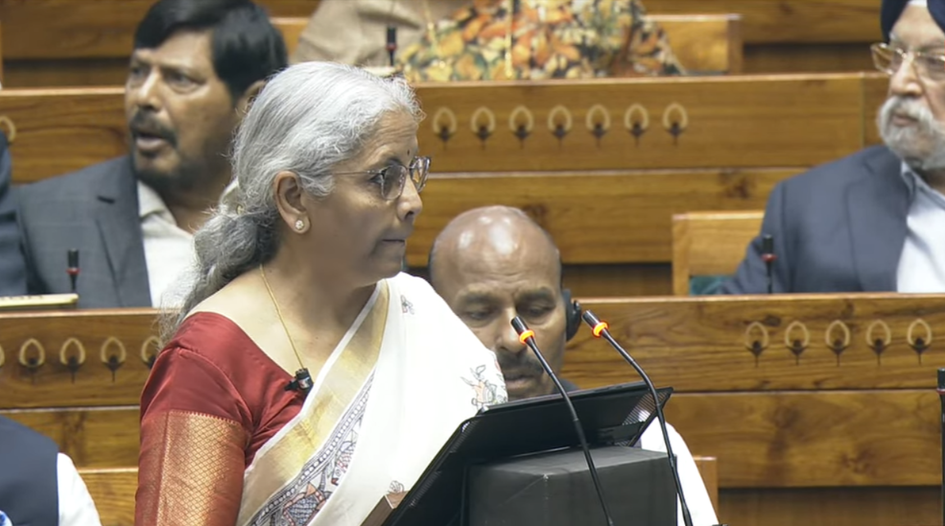

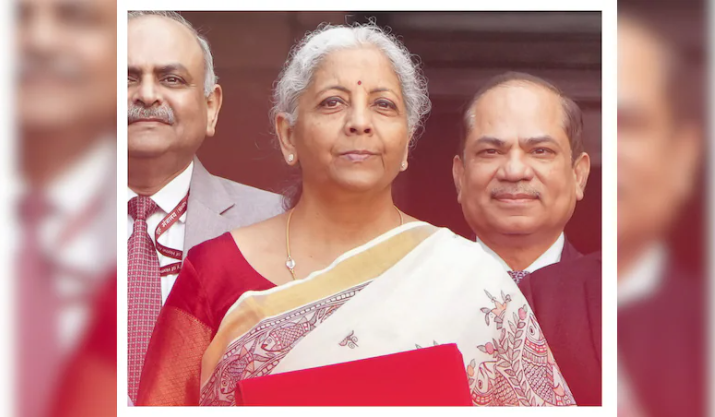

Union Budget 2025 LIVE Updates much-anticipated Union Budget 2025 was presented by Finance Minister Nirmala Sitharaman in Parliament today. In a significant relief to taxpayers, the Finance Minister announced that individuals earning up to ₹12 lakh per year will not have to pay any income tax under the new tax regime. This decision aims to boost disposable income, encourage spending, and stimulate economic growth.

Let’s delve into the key highlights of Budget 2025, its implications on taxpayers, Union Budget 2025 LIVE Updates industries, Union Budget 2025 LIVE Updates and the overall economy.

Key Announcements in Union Budget 2025

- Income Tax Relief: No Tax on Income Up to ₹12 Lakh Under New Regime

- Increase in Standard Deduction for Salaried Employees

- Revised Tax Slabs Under the New Regime

- Focus on Infrastructure and Capital Expenditure

- Boost for Startups and MSMEs

- Major Allocations for Healthcare and Education

- Agriculture Sector Reforms and Support

- New Policies for Green Energy and Sustainability

- Disinvestment and Privatization Plans

- Digital India and Technological Advancements

Let’s explore each aspect in detail.

1. No Income Tax on Income Up to ₹12 Lakh

One of the biggest takeaways from the Budget 2025 is the increase in the income tax exemption limit under the new tax regime. Previously, the tax-free income limit was ₹7 lakh. Now, individuals earning up to ₹12 lakh annually will be completely exempt from paying any income tax under the new tax regime.

This is expected to benefit the middle class significantly, Union Budget 2025 LIVE Updates as it will increase disposable income and encourage higher spending, thus boosting the economy.

New Income Tax Slabs Under the New Regime

| Income Range (₹) | Tax Rate (%) |

|---|---|

| 0 – 12,00,000 | 0 (No Tax) |

| 12,00,001 – 15,00,000 | 10% |

| 15,00,001 – 20,00,000 | 15% |

| 20,00,001 – 25,00,000 | 20% |

| Above 25,00,000 | 30% |

The revised tax slabs will make taxation more progressive and provide relief to a larger section of taxpayers.

2. Standard Deduction Increased for Salaried Individuals

To further support salaried employees, the government has increased the standard deduction from ₹50,000 to ₹75,000. This move is aimed at easing the tax burden on the working class and increasing their savings.

3. Boost for Infrastructure and Capital Expenditure

The government has allocated a record ₹12 lakh crore for infrastructure development. This includes investments in highways, railways, smart cities, and rural infrastructure.

- ₹3 lakh crore allocated for road and highway expansion.

- ₹2.5 lakh crore for railway modernization, Union Budget 2025 LIVE Updates including new bullet train projects.

- ₹1.8 lakh crore for smart city projects and urban development.

These investments are expected to create jobs, improve connectivity, and boost economic growth.

4. Support for Startups and MSMEs

The government continues its push for startups and MSMEs (Micro, Small, and Medium Enterprises) with several new initiatives:

- Corporate tax reduction for startups from 25% to 20%.

- Easy credit access for MSMEs with a new ₹50,000 crore loan guarantee scheme.

- Tax incentives extended for startups until 2028.

These measures will encourage entrepreneurship and job creation.

5. Major Allocations for Healthcare and Education

The government has made significant allocations to healthcare and education:

- ₹1.5 lakh crore for the healthcare sector, including expansion of AIIMS hospitals and medical colleges.

- ₹1.2 lakh crore for education, Union Budget 2025 LIVE Updates with a focus on digital learning and skill development programs.

- Free health insurance for BPL (Below Poverty Line) families under Ayushman Bharat scheme.

These initiatives aim to improve access to quality healthcare and education across the country.  For the more information click on this link

For the more information click on this link

6. Agricultural Reforms and Farmer Support

For the agricultural sector, the government has introduced:

- Increase in MSP (Minimum Support Price) for key crops.

- ₹2 lakh crore allocation for rural development and irrigation projects.

- Subsidies for organic and sustainable farming practices.

The aim is to ensure higher incomes for farmers and promote sustainable agriculture.

7. Green Energy and Sustainability Focus

The budget highlights the government’s commitment to clean energy and sustainability:

- ₹1.5 lakh crore for renewable energy projects.

- Subsidies for electric vehicles (EVs) and solar energy projects.

- Tax incentives for green businesses.

These initiatives will help India achieve its carbon neutrality goals.

8. Disinvestment and Privatization Plans

The government has announced plans to privatize certain PSUs (Public Sector Undertakings) and raise ₹1.75 lakh crore through disinvestment.

- Sale of stakes in select public sector banks and insurance companies.

- Privatization of underperforming state-owned enterprises.

This move is aimed at improving efficiency and attracting private investment.

9. Digital India and Technological Advancements

The budget emphasizes technological advancements and digital transformation:

- ₹1.2 lakh crore allocated for Digital India initiatives.

- 5G rollout to be expanded across all major cities.

- AI and blockchain technology integration in government services.

These steps will boost India’s digital economy and create new job opportunities.

10. Fiscal Deficit and Economic Growth Projections

The Finance Minister announced that India’s fiscal deficit is projected to be 5.3% of GDP in 2025, down from 5.9% in 2024.

- GDP growth forecasted at 7.2% for FY 2025-26.

- Inflation expected to remain within 4%.

These projections indicate a stable and growing economy with a focus on fiscal discipline.

Reactions to the Union Budget 2025

Experts’ Views

Economists and financial analysts have welcomed the tax relief measures, stating that they will boost consumer spending and economic growth. However, Union Budget 2025 LIVE Updates some have raised concerns about the fiscal deficit and the need for higher revenue generation.

Political Reactions

- Ruling Party: Hailed the budget as “pro-people and pro-development.”

- Opposition: Criticized the government for “not addressing unemployment and rising fuel prices.”

Stock Market Response

The stock market reacted positively to the budget announcements, Union Budget 2025 LIVE Updates with the Sensex rising by over 800 points and the Nifty reaching a record high.  For the more information click on this link

For the more information click on this link

Conclusion: A Budget for Growth and Relief

The Union Budget 2025 has introduced major tax reforms, infrastructure investments, and growth-oriented policies. The increase in the income tax exemption limit to ₹12 lakh is a game-changer for the middle class.

With strong investments in healthcare, education, agriculture, and green energy, the government aims to build a stronger and more sustainable economy.

As India moves forward, this budget sets the foundation for a prosperous and financially stable future.

FAQs on Union Budget 2025

1. What is the new income tax exemption limit?

- Individuals earning up to ₹12 lakh annually will not have to pay any income tax under the new tax regime.

2. How does the budget support salaried employees?

- The standard deduction has been increased from ₹50,000 to ₹75,000.

3. What are the key sectors benefiting from the budget?

- Infrastructure, MSMEs, healthcare, education, Union Budget 2025 LIVE Updates and green energy are the major beneficiaries.

4. What is the fiscal deficit target for 2025?

- The government has set a fiscal deficit target of 5.3% of GDP.

5. How will this budget impact the common man?

- With lower taxes, better infrastructure, and increased spending in healthcare and education, the budget aims to improve the standard of living for all. ALSO READ:- Novak Djokovic Alleges Poisoning Before 2022 Australian Open Deportation 2025