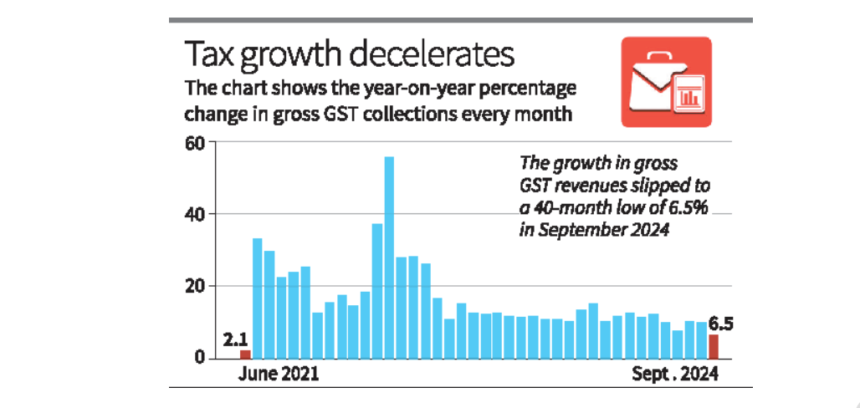

The Goods and Services Tax (GST) collections in September 2024 witnessed a modest growth, with total net inflows nearing ₹1.53 lakh crore. This marks a significant point in the economic performance of the country as the rate of growth slowed down compared to the earlier months of the year. While gross revenues saw a 6.5% increase, net receipts registered a lower rise of 3.9% compared to September 2023. The slowdown comes in the context of varied economic performances across states, with seven states experiencing a contraction in their GST revenues and Gujarat seeing flat revenue growth. One notable factor contributing to this overall performance was a rise in domestic refunds, which surged to 24.3%.

This article delves into the various aspects of this economic data, analyzing the reasons for the slowdown, the impact on different states, the significance of the rise in domestic refunds, and what it means for the Indian economy going forward.

Understanding GST and its Importance

The GST is one of the most important indirect tax reforms in India, implemented to simplify the tax structure by subsuming various central and state taxes. Since its implementation, GST has become a major source of revenue for both the central and state governments. The GST collection data is also a key indicator of the country’s economic health, as it reflects consumption patterns, production levels, and overall economic activity.

A consistent rise in GST collections is typically seen as a sign of robust economic activity, while any slowdown or contraction may signal underlying economic challenges, be it in terms of demand, production, or broader fiscal health.

Gross Revenues and Net Receipts: A Detailed Overview

In September 2024, India’s gross GST revenues rose by 6.5% year-on-year to reach ₹1.53 lakh crore. Despite this rise, the pace of growth is slower compared to the previous months, indicating a deceleration in economic activity.

Net receipts, which reflect the total tax collection after adjusting for refunds, recorded a 3.9% increase compared to the previous year. While this is still a positive growth, the gap between gross revenues and net receipts underscores an increase in refunds, which has contributed to the relatively slower growth in net inflows.

Refunds are a crucial element in the GST system, aimed at preventing the cascading effect of taxes. The rise in refunds this year, particularly the 24.3% increase in domestic refunds, suggests that more businesses are claiming back taxes on inputs, possibly due to slower sales or export activities.

State-Wise Revenue Performance

The GST growth patterns across states have been uneven. Seven states recorded a contraction in their GST revenues compared to September 2023, while Gujarat’s revenues remained largely flat. This suggests that the economic recovery, post-pandemic and post-global disruptions, has not been uniform across the country. Several factors could be contributing to this uneven recovery, including differences in industrial performance, consumption patterns, and regional economic policies.

States with Contraction in GST Revenues

States experiencing a contraction in GST revenues face challenges such as lower production, reduced consumption, or declines in specific industries. These contractions could also result from reduced business activity, weaker demand, or disruptions in supply chains. For instance, states dependent on tourism or hospitality may continue to face struggles, while those reliant on manufacturing might experience slower growth due to global economic uncertainty.

Flat Revenue Growth in Gujarat

Gujarat, one of India’s most industrially advanced states, witnessed flat growth in GST revenues. This stagnation is noteworthy, as Gujarat typically posts strong revenue growth due to its robust industrial base, ports, and commercial activity. The flat growth may be attributed to sluggish demand or the impact of global economic factors such as reduced exports and increased input costs.

States with Positive Growth

On the other hand, several states did experience positive growth in GST revenues. These states likely benefited from a surge in domestic consumption, a recovery in specific sectors like manufacturing or services, or increased government spending on infrastructure projects. A detailed analysis of sectoral performance could provide more insights into why some states outperformed others.

The Surge in Domestic Refunds: A Key Factor

One of the most significant highlights of the September GST data is the sharp rise in domestic refunds, which jumped by 24.3%. Refunds are typically claimed by businesses on the input taxes they pay when producing goods or services, especially when those goods are exported or sold in the course of business.

Several factors might explain this rise in refunds:

- Increase in Exports: If businesses are exporting more goods, they are entitled to claim refunds on the GST they paid on inputs. The global demand for Indian goods, despite the economic slowdown in some countries, might still be strong, leading to higher refund claims.

- Slower Sales in the Domestic Market: Another reason could be slower domestic sales, prompting businesses to seek refunds on input taxes for goods that have not been sold or for goods produced in anticipation of future sales.

- Inventory Accumulation: Businesses might be accumulating inventory, leading to higher input tax payments without corresponding output tax collections. This would also trigger an increase in refund claims.

The rise in refunds is a double-edged sword. On the one hand, it indicates that businesses are actively engaging in production and trade, especially exports. On the other hand, it also reduces the net GST collections, affecting the fiscal health of the government.

Impact on the Indian Economy

The slower growth in GST collections raises several concerns for the broader Indian economy. GST collections are a critical source of revenue for the government, and any slowdown in these collections can affect government spending on critical infrastructure, social welfare programs, and other essential services.

Government’s Fiscal Position

The Indian government has set ambitious spending targets, particularly in infrastructure, health, and education. These expenditures are necessary for sustaining long-term economic growth. A slowdown in GST collections could limit the government’s fiscal capacity to meet these targets, leading to potential delays in infrastructure projects or cuts in social welfare programs.

Private Sector Performance

The slower growth in GST collections could also indicate underlying weakness in the private sector. Reduced consumption and lower production levels may reflect weak demand, either due to inflationary pressures, rising interest rates, or global economic uncertainties. The private sector’s performance is critical to sustaining economic growth, and a slowdown here could affect job creation and income levels.

Exports and Global Demand

The rise in refunds might also indicate a shift towards export-oriented growth, with businesses claiming back taxes on inputs used for exported goods. While this is positive in terms of global trade, it might also suggest weak domestic demand. A healthy balance between domestic consumption and exports is essential for long-term growth.

Looking Ahead: Policy Implications

Given the slowdown in GST collections, the government might need to reassess its fiscal and economic policies. Several measures could be considered to address this situation:

- Boosting Consumption: One of the most effective ways to increase GST collections is to boost consumption. The government could consider policies aimed at increasing disposable income, reducing inflationary pressures, or offering incentives for consumer spending.

- Supporting Key Industries: Targeted support for industries that are struggling could help stimulate production and consumption. For instance, sectors such as manufacturing, tourism, and hospitality could benefit from government incentives or tax breaks.

- Monitoring Refunds: While refunds are an essential part of the GST system, ensuring that the process is not being misused is crucial. The government could implement stricter monitoring and auditing of refund claims to ensure that only legitimate claims are processed.

- Strengthening Export Competitiveness: As businesses claim more refunds due to exports, the government could focus on enhancing the competitiveness of Indian goods in the global market. This could involve investing in infrastructure, reducing logistical bottlenecks, and negotiating better trade deals with key partners.

- Balancing State Revenues: Since GST revenues are crucial for state governments, ensuring that states facing contractions are supported is vital. This could involve offering financial aid, incentivizing industrial growth, or reallocating central funds to struggling regions.

Conclusion

The slower growth in GST collections in September 2024 is a reflection of broader economic challenges, both domestically and globally. While gross revenues rose by 6.5%, net receipts grew by only 3.9%, and seven states experienced contractions in their GST revenues. The rise in domestic refunds, driven by increased exports and weaker domestic demand, has further contributed to the slower growth in net collections.

The government will need to carefully navigate these challenges, balancing its fiscal responsibilities with the need to stimulate economic activity. By boosting consumption, supporting struggling industries, and ensuring the integrity of the refund process, the government can work towards a more stable and sustained growth trajectory for GST collections. Ultimately, the performance of GST revenues will be a key indicator of India’s economic resilience in the face of global uncertainties. ALSO READ:- U.S. FDA Issues 10 Observations to Aurobindo Arm’s API Unit: Navigating Regulatory Compliance in the Pharmaceutical Industry 2024

mobile windshield repair 29302

29303 back glass replacement

29306 back glass replacement

auto glass discount 29304

I gained so much clarity from this article.

This had me hooked from the very first sentence — incredible work!