1. Introduction

In a significant move within the Indian financial and educational sectors, HDFC Bank has announced its intention to divest its holding in HDFC Edu to an HCL Group company. This decision marks a strategic shift for both HDFC Bank and HCL, reflecting the evolving landscape of the education sector in India. This article delves into the implications of this divestment, the motivations behind it, and what it signifies for the stakeholders involved.

2. Overview of HDFC Bank and HDFC Edu

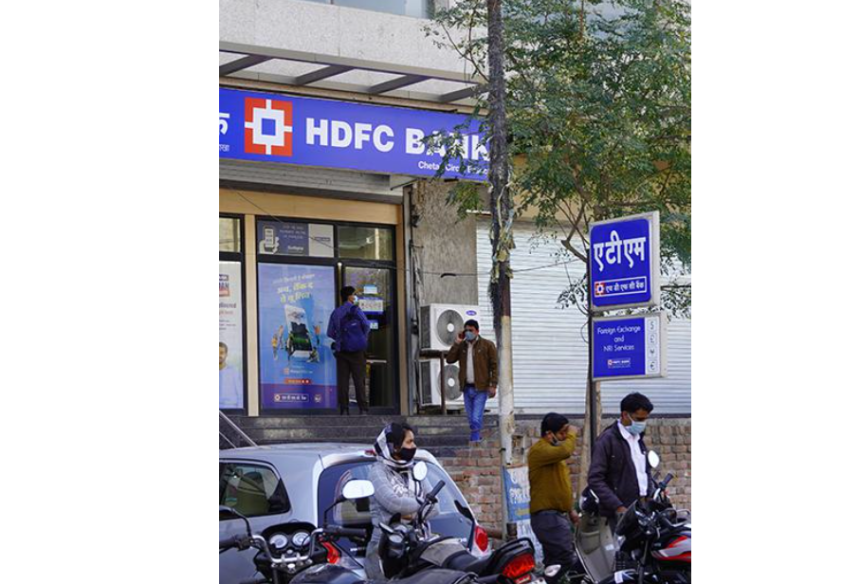

2.1 HDFC Bank: A Leader in Indian Banking

Founded in 1994, HDFC Bank has grown to become one of India’s leading private sector banks. Known for its robust financial services, customer-centric approach, and innovative banking solutions, HDFC Bank has carved a niche in the retail and wholesale banking sectors.

2.2 HDFC Edu: Bridging Education and Financial Services

HDFC Edu, a subsidiary of HDFC Bank, focuses on providing educational services and financing solutions. The company aims to make quality education accessible to a wider audience, offering loans and financial products tailored for students and educational institutions.

3. The Divestment: Key Details

3.1 Announcement of Divestment

HDFC Bank’s decision to divest its stake in HDFC Edu was officially announced in a press release that detailed the terms of the transaction. The bank has expressed its intention to focus on its core banking operations, leading to the strategic decision to sell its stake in the educational sector.

3.2 Details of the Transaction

While the exact terms and financial details of the divestment have not been publicly disclosed, it is expected that the deal will involve a substantial transfer of shares and financial interests from HDFC Bank to the HCL Group company. This divestment is part of a broader trend in the corporate world, where companies are realigning their business models to focus on core competencies.

4. Reasons Behind the Divestment

4.1 Strategic Focus on Core Banking Operations

HDFC Bank has consistently prioritized its banking operations and customer service. The decision to divest its stake in HDFC Edu allows the bank to streamline its focus on core activities, such as retail banking, corporate banking, and digital transformation initiatives.

4.2 Changing Dynamics in the Education Sector

The education sector in India is undergoing rapid changes, driven by technological advancements and the growing demand for digital learning solutions. HDFC Bank’s decision to divest may stem from a recognition that it is more advantageous to partner with a technology-driven company like HCL rather than continue operating in the education sector independently.

4.3 Potential for HCL to Drive Innovation

HCL, with its strong background in technology and services, is well-positioned to leverage HDFC Edu’s existing framework and enhance its offerings. By divesting to HCL, HDFC Bank is aligning with a partner capable of driving innovation and digital transformation within the education space.

5. Implications for Stakeholders

5.1 Impact on HDFC Bank

For HDFC Bank, divesting its stake in HDFC Edu means a renewed focus on banking operations and potentially improved financial performance. By reallocating resources away from the education sector, the bank can enhance its operational efficiency and profitability.

5.2 Benefits for HCL Group

The acquisition of HDFC Edu presents an opportunity for HCL to diversify its portfolio and enhance its presence in the education sector. With a focus on technology, HCL can integrate digital solutions into HDFC Edu’s offerings, thereby improving accessibility and learning outcomes.

5.3 Implications for Students and Educational Institutions

For students and educational institutions, the divestment may lead to enhanced services and financial products that are better aligned with current market needs. HCL’s expertise in technology may drive innovation in educational financing and services, improving access to quality education for a broader audience.

6. Market Reactions and Expert Opinions

6.1 Investor Sentiment

The announcement of the divestment has garnered mixed reactions from investors and market analysts. While some view it as a strategic move that allows HDFC Bank to sharpen its focus, others express concerns about the long-term implications for the educational financing landscape.

6.2 Expert Insights

Financial analysts have noted that this divestment aligns with broader trends in corporate restructuring, where companies prioritize core business areas in response to changing market dynamics. The collaboration between HDFC Edu and HCL is seen as a positive step towards fostering innovation in education.

7. Future Prospects for HDFC Edu and HCL

7.1 Growth Opportunities for HDFC Edu

With HCL’s backing, HDFC Edu is poised to explore new growth avenues, such as expanding its digital offerings and reaching out to a wider student demographic. The integration of advanced technology can potentially lead to improved educational financing solutions and enhanced user experiences.

7.2 HCL’s Role in Educational Innovation

HCL’s foray into the education sector through HDFC Edu allows the company to apply its technological expertise to create innovative solutions that cater to the evolving needs of students and educational institutions. This partnership may lead to the development of platforms that facilitate online learning, skill development, and more.

8. Regulatory Considerations

8.1 Compliance with Regulatory Framework

The divestment will need to comply with the regulatory requirements set by the Reserve Bank of India (RBI) and other relevant authorities. Both HDFC Bank and HCL must ensure that the transaction adheres to the legal and regulatory frameworks governing such corporate transactions.

8.2 Impact on Market Competition

The divestment could potentially influence the competitive landscape within the education financing sector, prompting other financial institutions to reevaluate their strategies in light of this development.

9. Conclusion

HDFC Bank’s decision to divest its holding in HDFC Edu to an HCL Group company marks a pivotal moment in the intersection of finance and education in India. By realigning its focus on core banking operations, HDFC Bank aims to enhance its operational efficiency and profitability. Simultaneously, HCL’s entry into the education sector through this acquisition presents opportunities for innovation and growth.

As the education sector continues to evolve, this strategic move highlights the importance of collaboration between financial institutions and technology-driven companies in addressing the needs of students and educational institutions. The future of HDFC Edu under HCL’s guidance looks promising, with the potential for significant advancements in educational financing and services. ALSO READ:-RBI’s Das Warns of Action on Aggressive NBFCs: A Call for Prudence in Financial Practices 2024

Промокоды на Лаки Джет от 1WIN уже доступны!

Сравни предложения — выбери лучший микрокредит

Quick aviator game review for beginners

Зеркало казино — стабильный способ входа