Afcons Infrastructure, a part of the Shapoorji Pallonji Group, is set to open its Initial Public Offering (IPO) to the public this Friday, marking a significant milestone in its journey as one of India’s most renowned infrastructure development firms. The IPO will provide an opportunity for investors to become a part of one of the country’s most dynamic engineering companies that has an extensive portfolio in infrastructure, civil engineering, and construction.

In this comprehensive article, we will explore Afcons Infra’s history, its impressive accomplishments, the details of its upcoming IPO, and why investors may find this an attractive opportunity.

Overview of Afcons Infrastructure

A Legacy of Excellence

Afcons Infrastructure is the construction and engineering arm of the Shapoorji Pallonji Group, which has a rich legacy spanning over 150 years. Afcons itself boasts over six decades of experience in delivering high-quality infrastructure projects, both in India and abroad. Its projects range from bridges and tunnels to ports, metro systems, and oil & gas facilities.

The company’s strength lies in its ability to take on highly challenging projects, such as the construction of India’s highest railway bridge (the Chenab Bridge) and the development of metro systems in multiple cities, including Mumbai and Kolkata. Afcons’ expertise also extends internationally, with projects completed in over 25 countries across Africa, the Middle East, and South Asia.

Key Projects and Global Presence

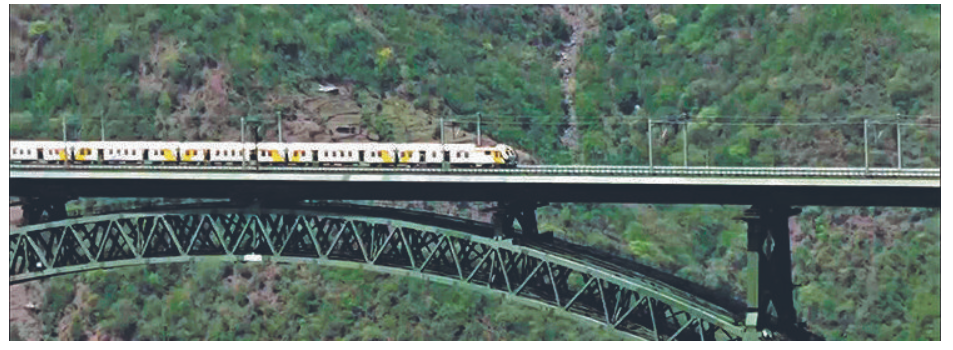

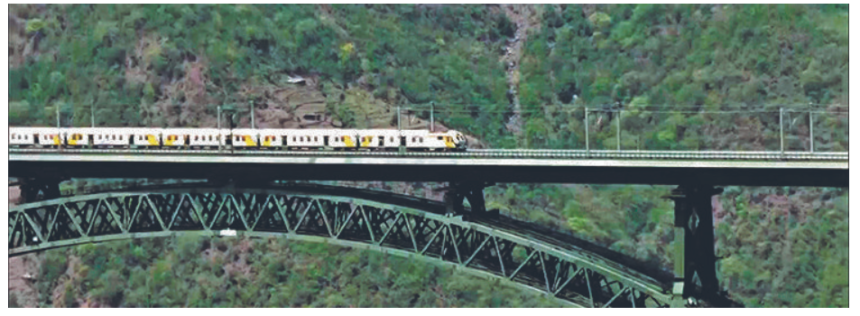

One of Afcons’ standout projects is the engineering marvel featured in the image above, the Chenab Railway Bridge, known as the world’s highest rail bridge, surpassing even the Eiffel Tower in height. This project is a testament to the company’s engineering capabilities, representing a blend of complex structural design, technology, and resilience.

In addition to iconic bridges, Afcons has delivered metro rail systems, marine structures, and roads in various regions, contributing significantly to the development of transportation and logistics infrastructure.

Its international projects include ports in Ghana, Egypt, and Sri Lanka, metro systems in Dubai, and offshore platforms for oil & gas industries in Qatar and Iran.

Financial Strength and Growth

Afcons’ financial performance over the past few years has been impressive. The company has consistently demonstrated growth in revenue and profitability. Its order book is robust, filled with prestigious contracts both in India and globally. The company’s strong track record in project delivery, coupled with its financial prudence, makes it a solid player in the infrastructure sector.

The company reported total revenue of INR 9,000 crore for the financial year ending 2023, with a healthy profit margin and an order book valued at over INR 50,000 crore. This financial health reflects Afcons’ ability to navigate both domestic and global challenges in the construction industry.

IPO Details: What Investors Should Know

Afcons Infrastructure is expected to raise substantial capital through this public issue. Here are the key details regarding the IPO:

- IPO Date: The IPO will open on Friday, offering investors an opportunity to buy shares at the listed price.

- Price Band: The price range for the IPO is expected to be between INR 750 and INR 780 per share, offering an attractive valuation for both retail and institutional investors.

- Lot Size: Investors can bid in a minimum lot size of 20 shares, which makes it accessible to retail investors. The maximum lot size for retail investors is capped at 240 shares.

- Issue Size: The total issue size is expected to be around INR 3,500 crore, which will consist of both fresh issue shares and an offer for sale from the promoters.

- Use of Proceeds: The funds raised through this IPO will be used for multiple purposes, including repayment of debt, financing new projects, and general corporate purposes. This is expected to improve the company’s balance sheet and provide greater financial flexibility for future expansion.

Why Invest in Afcons Infra?

Afcons’ IPO is generating significant buzz for several reasons, making it an appealing prospect for investors:

1. Proven Track Record

Afcons has successfully completed some of the most challenging engineering projects in India and abroad. Its ability to deliver complex infrastructure on time and within budget gives it a competitive edge. Investors who value a company with a consistent track record of performance will find Afcons a compelling option.

2. Robust Order Book

Afcons’ order book, worth INR 50,000 crore, provides strong revenue visibility for the next few years. The company’s diversified portfolio of projects across multiple sectors, such as transportation, marine, and energy, reduces its dependency on any single market. This risk diversification enhances its long-term growth potential.

3. Global Footprint

With a presence in over 25 countries, Afcons has established itself as a global player in the infrastructure and engineering sector. Its international exposure not only provides growth opportunities but also insulates the company from domestic economic fluctuations. As governments worldwide continue to invest in infrastructure development, Afcons is well-positioned to capture new opportunities.

4. Strong Financial Performance

Afcons’ solid financial performance in recent years further strengthens its investment case. With stable revenue growth, healthy profit margins, and a manageable debt profile, the company stands out in a sector known for high capital intensity. The capital raised from the IPO is expected to be used for debt reduction, further improving the company’s financial health.

5. Favorable Industry Outlook

India’s infrastructure sector is poised for significant growth in the coming years. The Indian government has prioritized infrastructure development as a key driver for economic growth, with significant investments allocated in sectors like transportation, urban development, and energy. Afcons, with its strong presence and proven capabilities, is well-positioned to benefit from this positive industry outlook.

Moreover, the global infrastructure demand is also on the rise, driven by urbanization, technological advancements, and the need for resilient infrastructure in the face of climate change. Afcons’ global experience and diversified expertise make it a strong contender to tap into these emerging opportunities.

6. Reputation and Backing

As part of the Shapoorji Pallonji Group, Afcons benefits from its parent company’s reputation, resources, and market credibility. The group’s long-standing legacy in the construction and real estate sectors adds to Afcons’ credibility, offering assurance to investors about the firm’s stability and governance.

Risks and Considerations

While Afcons presents a strong case for investment, it is essential for investors to consider the risks associated with the IPO and the infrastructure sector.

1. High Capital Intensity

The infrastructure sector is capital-intensive, and companies like Afcons need to constantly invest in equipment, technology, and skilled labor. While the proceeds from the IPO will help reduce debt, the company may still need to raise additional capital in the future to finance large projects.

2. Project Delays and Cost Overruns

Large infrastructure projects are often subject to delays due to various factors, including regulatory hurdles, environmental concerns, and logistical challenges. These delays can lead to cost overruns, impacting the company’s profitability and financial performance.

3. Economic Slowdown

While Afcons has a diversified portfolio, a significant slowdown in either the domestic or global economy could impact its growth prospects. Infrastructure investments are often linked to economic cycles, and any prolonged slowdown could lead to reduced government spending on new projects.

4. Geopolitical Risks

Afcons’ international operations expose the company to geopolitical risks in regions where it operates. Changes in political leadership, economic sanctions, or trade barriers in these countries could affect the company’s ability to execute projects or win new contracts.

Conclusion: A Promising Investment Opportunity

Afcons Infrastructure’s IPO comes at a time when the company is well-positioned to capitalize on both domestic and global growth opportunities in the infrastructure sector. With its proven track record, robust order book, and strong financial performance, Afcons offers a compelling investment case for both retail and institutional investors.

While there are risks associated with the infrastructure sector, the company’s diversified project portfolio, global presence, and backing from the Shapoorji Pallonji Group provide it with a solid foundation for future growth. For investors seeking exposure to India’s infrastructure story, Afcons Infra’s IPO presents a promising opportunity to participate in one of the country’s most dynamic and reliable engineering firms.

As always, investors should conduct their due diligence, assess their risk appetite, and consult with financial advisors before making any investment decisions. ALSO READ:- Abhishek Powers India-A to a Thumping Win Over UAE: A Star Performance in a Dominant Victory 2024

1win pro https://1win6001.ru/ .

мостбет промокод mostbet6006.ru .

1win зайти 1win зайти .

мостюет http://www.mostbet6006.ru .

1 вин вход http://familyclub.borda.ru/?1-6-0-00002163-000-0-0-1743051813/ .

1 вин https://www.familyclub.borda.ru/?1-6-0-00002163-000-0-0-1743051813 .

мостюет mostbet6006.ru .

1win вход https://www.familyclub.borda.ru/?1-6-0-00002163-000-0-0-1743051813 .

1win rossvya http://www.alfatraders.borda.ru/?1-0-0-00004932-000-0-0-1743258210 .

1win сайт https://balashiha.myqip.ru/?1-12-0-00000437-000-0-0-1743258848 .

вход 1win http://balashiha.myqip.ru/?1-12-0-00000437-000-0-0-1743258848/ .

1вин официальный сайт мобильная 1вин официальный сайт мобильная .

1vin pro 1win6049.ru .

1вин официальный сайт вход http://1win6049.ru .

скачать 1win официальный сайт http://balashiha.myqip.ru/?1-12-0-00000437-000-0-0-1743258848/ .

1 вин вход в личный кабинет 1 вин вход в личный кабинет .

1вин официальный мобильная 1win6050.ru .

скачат мостбет https://svstrazh.forum24.ru/?1-18-0-00000136-000-0-0-1743260517 .

мосбет svstrazh.forum24.ru/?1-18-0-00000136-000-0-0-1743260517 .

1.вин https://www.1win6050.ru .

1win ваучер http://obovsem.myqip.ru/?1-9-0-00000059-000-0-0-1743051936 .

1 win сайт https://www.obovsem.myqip.ru/?1-9-0-00000059-000-0-0-1743051936 .

mostbet скачать на телефон бесплатно андроид http://svstrazh.forum24.ru/?1-18-0-00000136-000-0-0-1743260517/ .

1win,com http://obovsem.myqip.ru/?1-9-0-00000059-000-0-0-1743051936 .

1win.kg http://1win6051.ru/ .

1 win.com 1win6051.ru .

1win казино http://1win6052.ru/ .

1вин вход 1вин вход .

1vin http://www.1win6052.ru .

1вин бет официальный сайт https://1win6051.ru/ .

1win com http://www.1win6052.ru .

мостбет кг http://www.mostbet6029.ru .

скачать мостбет скачать мостбет .

1wiun 1win6053.ru .

1 win pro https://1win6053.ru/ .

1win.pro https://1win5011.ru/ .

1win.pro https://1win5011.ru .

ван вин https://1win6009.ru .

1вин rossvya https://1win6009.ru/ .

казино онлайн kg http://www.mostbet6012.ru .

mostbet скачать http://mostbet6012.ru .

мосбет казино http://mostbet6012.ru .

бк 1win https://1win6046.ru/ .

уннв скачать бесплатно https://25kat.ru/music/уннв/ .

пластиковые окна купить в новосибирске http://oknasibirinsk.ru .

1win apk download 1win apk download .

банкротство физлиц http://www.bankrotstvo-fiz-lic-moscow.ru .

купить диплом о среднем образовании в москве http://arus-diplom6.ru .

отзывы https://niksolovov.ru/services/time-master 2025

Thanks for the article. Here’s more on the topic https://artcet.ru/

Thanks for the article. Here’s more on the topic https://cultureinthecity.ru/

Here’s more on the topic https://bediva.ru/

где купить настоящий аттестат за 11 класс где купить настоящий аттестат за 11 класс .

аттестат за 10 11 класс купить аттестат за 10 11 класс купить .

скачать музыку бесплатно в хорошем качестве без регистрации на телефон с прослушиванием русские все скачать музыку бесплатно в хорошем качестве без регистрации на телефон с прослушиванием русские все .

I recommend best promo code 1xbet philippines

скачать музыку бесплатно в хорошем качестве на телефон скачать музыку бесплатно в хорошем качестве на телефон .

Thanks for the article http://web-lance.net/forums.php?m=posts&q=29456&n=last#bottom .

Thanks for the article http://aku.ukrbb.net/viewtopic.php?f=10&t=19538 .

Website https://portalbook.ru/arenda-avtomobilya-dlya-povsednevnyh-zadach-i-poezdok-po-gorodudlya-povsednevnyh-zadach-i-poezdok-po-gorodu/