LIC’s In the ever-evolving world of finance, the Life Insurance Corporation of India (LIC) stands as a beacon of stability and trust, providing essential insurance services to millions across the nation. However, like any institution, LIC is not immune to challenges. In its latest quarterly report, while there’s a glimmer of positive news with a 2.5% rise in net profits, there’s also a cloud looming over its growth trajectory due to unresolved issues of wage arrears and benefits owed to its employees. Today, let’s delve into the intricacies of LIC’s performance, unpacking the highs and lows that shape its financial landscape.

LIC’s A Modest Rise in Net Profits:

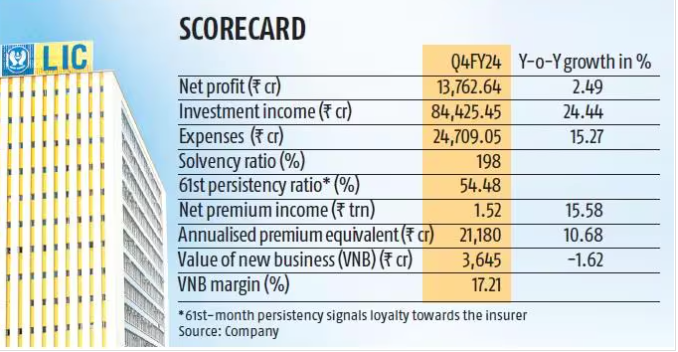

On the surface, a 2.5% increase in net profits might seem like cause for celebration, especially in a time of economic uncertainty. This uptick reflects LIC’s resilience and ability to weather storms, maintaining a steady course amidst turbulent waters. However, behind this modest growth lies a tale of challenges yet to be overcome.

The Shadow of Wage Arrears and Benefits:

Central to LIC’s growth impediments are the lingering issues of wage arrears and benefits owed to its workforce. Employees, the lifeblood of any organization, deserve fair compensation for their hard work and dedication. Yet, the specter of unpaid wages casts a long shadow over LIC’s operations, impacting morale and productivity. Until these matters are satisfactorily addressed, the company’s growth prospects remain uncertain.

The Ripple Effect:

The repercussions of wage arrears and benefits issues extend far beyond LIC’s internal dynamics, permeating the broader economic landscape. A dissatisfied workforce, grappling with financial uncertainty, is less likely to perform at its peak, leading to decreased efficiency and productivity. Such ripple effects can stifle economic growth, posing challenges not only for LIC but for the entire economy.

Navigating Regulatory Challenges:

In addition to internal hurdles, LIC must contend with external pressures arising from a complex regulatory environment. As a key player in the insurance sector, LIC is subject to stringent regulations aimed at safeguarding consumer interests and maintaining market stability. While necessary, these regulations add layers of complexity to LIC’s operations, requiring careful navigation to remain compliant while staying competitive.

A Call for Transparency and Innovation:

To address these challenges, LIC must prioritize transparency and accountability in its operations. By fostering a culture of openness and honesty, LIC can build trust with its stakeholders, laying the groundwork for sustained growth and success. Additionally, the company should explore opportunities for innovation and diversification, leveraging emerging technologies to enhance its product offerings and reach new customer segments.

Embracing Digital Transformation:

In the age of digitalization, embracing technology is paramount for LIC’s future growth. By investing in digital transformation initiatives, LIC can streamline processes, enhance customer experiences, and improve operational efficiency. From online policy management to digital claims processing, technology offers a myriad of opportunities for LIC to stay ahead of the curve and meet the evolving needs of its customers.

Charting a Course for the Future:

As LIC navigates the complexities of the financial landscape, it must remain steadfast in its commitment to excellence and customer satisfaction. By addressing internal challenges, embracing innovation, and fostering a culture of transparency, LIC can chart a course towards a brighter and more prosperous future. As India’s premier life insurance provider, LIC has a responsibility to its stakeholders and society at large. By fulfilling this responsibility with integrity and foresight, LIC can continue to serve as a pillar of stability and trust for generations to come.

Conclusion:

In conclusion, while LIC’s Q4 net rise of 2.5% is a positive indicator of its resilience, the challenges posed by wage arrears and benefits issues underscore the need for concerted action. By prioritizing transparency, innovation, and employee welfare, LIC can overcome these obstacles and emerge stronger than ever. As LIC embarks on this journey of transformation, it must remain true to its core values, ensuring that its actions are guided by integrity, fairness, and a commitment to excellence. In doing so, LIC can continue to fulfill its mission of protecting lives and securing futures, serving as a beacon of hope and stability in an ever-changing world. ALSO READ:- Devastation in Papua New Guinea: Over 2,000 Buried in Landslip Tragedy