1. Introduction: A Notable Shift in Global Financial Dynamics

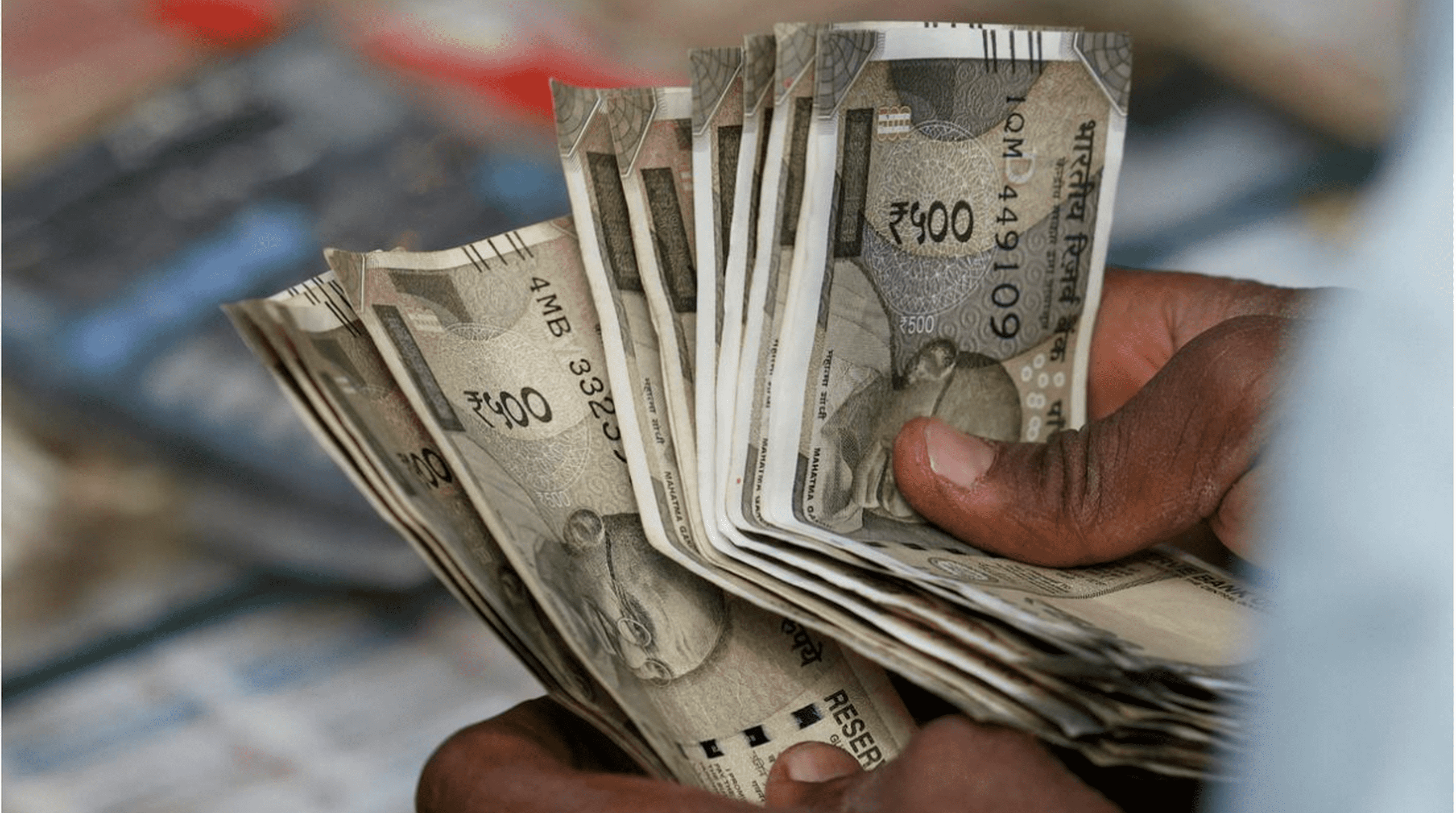

Rupee Strengthens in a development that underlines the intricate link between geopolitics and global financial markets, the Indian Rupee rose by 13 paise to trade at 85.92 per U.S. dollar in early trade. Simultaneously, Brent crude futures climbed to $68.01 per barrel, riding on the back of a geopolitical breakthrough—a ceasefire agreement between Iran and Israel, brokered by former U.S. President Donald Trump.

This convergence of currency appreciation and a spike in crude prices comes amid a backdrop of cautious optimism, global economic uncertainty, and persistent inflationary pressures. This article delves into the driving factors behind the rupee’s appreciation, the impact of Trump’s diplomatic move, and the potential repercussions on India’s economy and global oil markets.

2. Rupee’s Rise: A Welcome Boost Amid Global Volatility

The appreciation of the Indian Rupee against the U.S. Dollar by 13 paise, Rupee Strengthens reaching 85.92, is significant in light of ongoing currency pressures in emerging markets. Multiple contributing factors are in play:

2.1 Weakening of the U.S. Dollar Index

The U.S. Dollar Index (DXY) witnessed a slight correction after weeks of strength driven by Federal Reserve rate hikes and hawkish policy. The pause in aggressive tightening and dovish statements from Fed officials have eased the dollar’s momentum, thereby benefiting currencies like the rupee.

2.2 Foreign Inflows and Positive Sentiment

India has seen a rise in foreign portfolio investments (FPIs), particularly in the equity market. The return of global investors following easing geopolitical tensions has led to net positive inflows, Rupee Strengthens which support the rupee’s valuation.

2.3 Robust Economic Fundamentals

India’s GDP growth forecast remains one of the highest among major economies, and its foreign exchange reserves are at comfortable levels. The Reserve Bank of India (RBI) has also maintained a stable monetary policy, Rupee Strengthens keeping inflation in check while supporting growth.  watch video for more info

watch video for more info

3. Brent Crude Spikes: Understanding the Surge to $68.01 Per Barrel

3.1 Geopolitical Catalyst: The Trump-Brokered Ceasefire

Global oil prices are highly sensitive to geopolitical developments, especially in the Middle East, a region that holds over 50% of the world’s proven oil reserves. The news of a ceasefire between Iran and Israel, facilitated by Donald Trump, Rupee Strengthens sent shockwaves through the commodities market.

Traders and analysts fear any instability in the region could choke oil supplies, Rupee Strengthens especially from the Strait of Hormuz, a key chokepoint for global crude transportation. However, the ceasefire temporarily reduces the threat of disruption, but risk premiums still remain.

3.2 Speculative Trading and Futures Market Activity

The ceasefire, although calming, led to a surge in speculative trading. Traders rushed to hedge against future uncertainties, pushing up Brent crude futures to $68.01 per barrel, a notable jump in early trade sessions.

3.3 OPEC+ Production Strategy

At the same time, OPEC+ countries have maintained disciplined output cuts, Rupee Strengthens despite calls to increase production. Their strategy to keep supply tight while global demand gradually recovers has contributed to a steady uptick in crude prices.

4. India’s Energy Economics: Balancing the Rupee and Oil Prices

While a stronger rupee may help offset some of the burden of rising oil prices, India’s status as a major oil importer makes the country vulnerable to global crude fluctuations.

4.1 Impact on Trade Deficit

Rising crude prices can widen India’s trade deficit, as oil imports form a significant portion of total imports. However, Rupee Strengthens the stronger rupee could cushion the blow slightly by making oil purchases in dollar terms more affordable.

4.2 Inflation Concerns

Higher crude prices could stoke inflationary pressures, particularly in transportation and manufacturing sectors. The Indian government and RBI need to remain vigilant in managing the pass-through effect to retail inflation.

4.3 Fuel Pricing and Subsidies

Public sector oil marketing companies like IOCL, BPCL, and HPCL adjust retail fuel prices based on global rates. Rising Brent crude could lead to higher petrol and diesel prices, Rupee Strengthens impacting consumers. The government may have to reconsider its excise duties or offer temporary relief through subsidies.

5. The Global Picture: Ceasefire’s Broader Impact on Markets

5.1 Middle East Stability and Investor Confidence

The Trump-brokered ceasefire signals a potential diplomatic thaw between two archrivals. If sustained, this can lead to increased investor confidence in the region, Rupee Strengthens encouraging capital inflows and reducing risk aversion across global markets.

5.2 U.S. Foreign Policy and Oil Diplomacy

Trump’s re-emergence as a geopolitical dealmaker also has implications for U.S. foreign policy. If he continues to mediate or influence international affairs ahead of the 2024 elections, Rupee Strengthens market perceptions of American diplomacy may shift significantly.

5.3 Oil Market Volatility

While the ceasefire reduces immediate risk, underlying tensions remain unresolved. Iran’s nuclear ambitions, Israel’s security concerns, and U.S. sanctions policies are all factors that could reignite tensions. Hence, oil markets are likely to remain volatile.  watch video for more info

watch video for more info

6. Market Reactions: How Investors and Analysts Responded

6.1 Equity Markets

Indian stock markets opened on a positive note, buoyed by the strengthening rupee and easing geopolitical risks. The Sensex and Nifty showed early gains, particularly in oil & gas, Rupee Strengthens banking, and auto sectors.

6.2 Bond Markets

Indian government bond yields remained relatively stable, Rupee Strengthens as investors took comfort in the rupee’s strength and manageable inflation expectations.

6.3 Forex Reserves and RBI Strategy

With India’s forex reserves standing strong, the RBI is likely to continue its policy of mild intervention to maintain currency stability without distorting market sentiment.

7. Future Outlook: What Lies Ahead for the Rupee and Oil Prices

7.1 Rupee Forecast

Analysts predict the rupee may trade in a range of 85.50 to 86.20 in the short term, Rupee Strengthens depending on global dollar movement, oil prices, and FPI activity. Any deterioration in the ceasefire agreement or a sudden dollar resurgence could reverse gains.

7.2 Oil Price Trends

Brent crude is likely to hover between $65 and $72 in the coming weeks. Much will depend on how effectively the ceasefire holds, OPEC+ decisions, and the pace of global economic recovery, Rupee Strengthens especially in China and the U.S.

8. Conclusion: A Delicate Balance of Forces

The dual movement of the Indian rupee strengthening and Brent crude spiking presents a complex financial scenario. While the ceasefire brokered by Donald Trump offers temporary relief and stability in the Middle East, markets remain on alert.

For India, a stronger rupee offers some buffer against rising oil prices, but policymakers must tread cautiously. The RBI, the Finance Ministry, and the Ministry of Petroleum will need to work in tandem to ensure that inflation remains under control, Rupee Strengthens growth continues uninterrupted, and India’s fiscal health remains intact.

As always, in a world increasingly shaped by unpredictable geopolitics and economic interdependence, market participants must stay informed, agile, and ready to adapt. ALSO READ:- Know Word Count Karnataka’s Proposed 10-Hour Work Shifts: What You Need to Know Word Count: Approx 2025