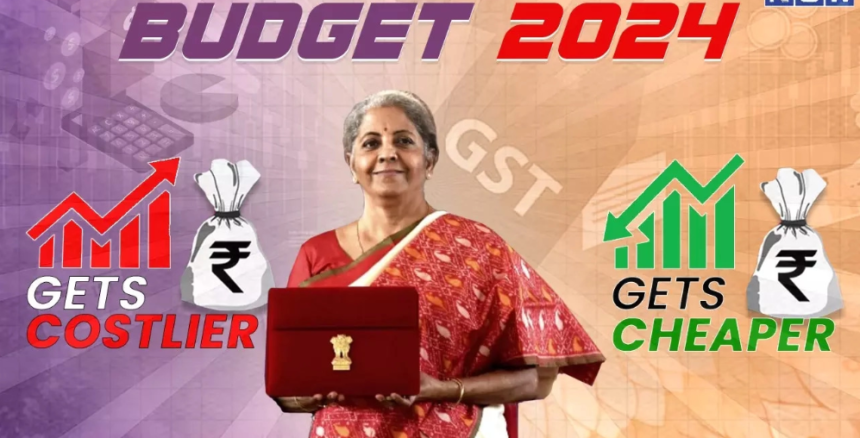

Union Finance Minister Nirmala Sitharaman has unveiled the Budget 2024, bringing with it a slew of changes affecting various goods and services. Notably, the proposed reduction in basic customs duty on mobile phones and chargers to 15% is set to make these essential items more affordable. Here’s a detailed look at what will become cheaper and what might cost more in the coming year, along with an analysis of the broader economic implications.

What Gets Cheaper?

Budget 2024 Mobile Phones and Related Products

Reduction in Customs Duty

The most significant change proposed in the Budget 2024 is the reduction of basic customs duty on mobile phones, mobile printed circuit board assemblies (PCBAs), and mobile chargers to 15%. This is a substantial decrease aimed at boosting the domestic electronics industry.

Budget 2024 Impact on Prices

- Mobile Phones: Consumers can expect lower prices for mobile phones, making them more accessible to a broader population. The reduced duty is likely to lead to a decrease in the overall cost of smartphones, potentially spurring higher sales.

- Mobile Chargers and PCBAs: Along with mobile phones, the reduction in duty for chargers and PCBAs will likely result in cheaper accessories and components, contributing to a more affordable ecosystem for mobile technology.

Industry Growth

The mobile phone and related products industry has seen remarkable growth:

- Domestic Production: There has been a three-fold increase in domestic production, indicating a robust manufacturing sector.

- Exports: Exports have surged almost 100-fold, reflecting India’s growing stature as a significant player in the global mobile phone market.

Electronic Goods

Apart from mobile phones, the reduction in customs duty on various electronic components is expected to make a range of electronic goods cheaper. This includes items like laptops, tablets, and other consumer electronics, fostering increased adoption and digital inclusion.

Electric Vehicles (EVs)

In a bid to promote sustainable transportation, the government has proposed incentives for electric vehicles. Reduction in customs duty on components for EV manufacturing could lead to lower prices for electric cars and bikes, making them a more attractive option for consumers.

Health and Hygiene Products

There are proposals to reduce taxes on certain health and hygiene products, including medical devices and essential medicines. This move aims to make healthcare more affordable and accessible, particularly in the wake of the COVID-19 pandemic.

Budget 2024 What Gets Costlier?

Luxury Goods

To balance the budget and curb the import of non-essential items, the government has increased customs duties on luxury goods. This includes high-end electronics, luxury cars, and premium alcoholic beverages. The aim is to discourage the import of these items and promote domestic alternatives.

Tobacco and Sugary Beverages

In line with public health goals, the government has proposed higher taxes on tobacco products and sugary beverages. The increased duties are intended to reduce consumption of these harmful products and generate additional revenue for health programs.

Imported Consumer Goods

Higher customs duties on certain imported consumer goods are expected to increase their prices. This includes items like imported furniture, home decor, and some categories of clothing. The policy is designed to encourage consumers to opt for domestically produced goods, supporting local industries.

Economic Implications

Boost to Domestic Manufacturing

The reduction in customs duties on mobile phones and related products is part of a broader strategy to boost domestic manufacturing. By making it cheaper to produce and assemble electronics in India, the government aims to create jobs, attract foreign investment, and position India as a global manufacturing hub.

Encouragement of Exports

With a significant increase in exports of mobile phones, the reduction in customs duties is likely to further enhance India’s competitiveness in the global market. Lower production costs can translate into more competitive pricing for Indian products abroad, driving export growth.

Digital Inclusion

Cheaper mobile phones and electronic goods can significantly enhance digital inclusion. As more people gain access to affordable technology, it can lead to greater connectivity, improved access to information, and increased opportunities for education and employment in the digital economy.

Sustainable Development

The incentives for electric vehicles and the reduction in taxes on health products align with the government’s goals of promoting sustainable development and public health. By making EVs more affordable, the government hopes to reduce carbon emissions and promote cleaner transportation.

Revenue Generation

While certain goods are set to become cheaper, the increased duties on luxury items and harmful products like tobacco and sugary beverages will help generate additional revenue. This revenue can be utilized for developmental projects and public welfare programs, balancing the fiscal impact of duty reductions.

Conclusion

The Budget 2024 reflects a strategic approach to fostering economic growth, promoting domestic manufacturing, and enhancing public welfare. The reduction in customs duties on mobile phones and related products is a significant step towards making technology more affordable and accessible, while higher duties on luxury goods and harmful products align with broader economic and public health goals.

As consumers and industries adapt to these changes, the overall impact is expected to be positive, driving growth, sustainability, and digital inclusion. The government’s focus on boosting exports and domestic manufacturing, coupled with measures to promote health and sustainability, positions India for a balanced and forward-looking economic trajectory in the coming year. ALSO READ:-NTA NEET UG 2024 Supreme Court Hearing Live Updates: ‘Re-test will disrupt schedule, course of medical education,’ SC says