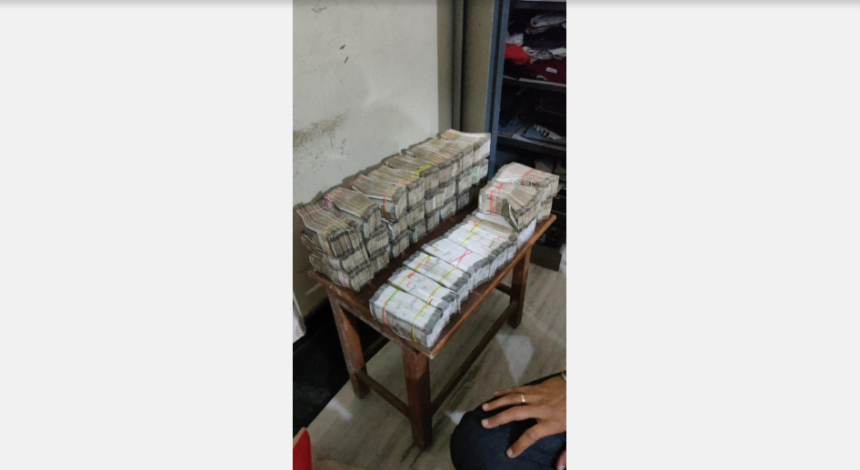

ED Seizes ₹170 Crore Bank Deposits in a major crackdown on illegal forex trading and financial fraud, ED Seizes ₹170 Crore Bank Deposits the Enforcement Directorate (ED) has seized ₹170 crore worth of bank deposits linked to a suspected fraudulent forex trading platform. The investigation, conducted under the Prevention of Money Laundering Act (PMLA), 2002, has exposed a widespread scam targeting thousands of Indian investors who were lured with promises of high returns in the foreign exchange market.

The ED’s probe revealed that the platform operated without regulatory approval, ED Seizes ₹170 Crore Bank Deposits misled investors with false promises, and laundered money through shell companies and offshore accounts. The seizure of funds marks a significant step in dismantling illegal financial networks that exploit innocent traders and investors.

The action has sent shockwaves across the forex trading community, financial regulators, and law enforcement agencies, as authorities tighten their grip on unauthorized online trading platforms.

Understanding the Fraud: How the Illegal Forex Trading Platform Operated

The ED’s investigation uncovered that the forex trading platform:

🔹 Promised guaranteed returns of 5%-10% per month to lure investors.

🔹 Operated without a license from SEBI or RBI, ED Seizes ₹170 Crore Bank Deposits violating Indian forex trading regulations.

🔹 Used fake AI-driven trading algorithms to mislead traders into believing in consistent profits.

🔹 Diverted funds to offshore accounts, cryptocurrency exchanges, and shell companies.

🔹 Ran a Ponzi-like scheme, using money from new investors to pay fake profits to older ones.

How Investors Were Trapped

1️⃣ High-Return Promises – The platform advertised itself aggressively on social media, claiming that users could earn quick and safe profits through forex trading.

2️⃣ Fake Success Stories – Investors saw fabricated testimonials and manipulated screenshots showing fake profits.

3️⃣ Referral Schemes – The scam encouraged users to bring in more investors, ED Seizes ₹170 Crore Bank Deposits creating a multi-level marketing (MLM)-style Ponzi structure.

4️⃣ Blocked Withdrawals – As soon as the platform gained significant deposits, withdrawal requests were blocked, leaving investors unable to recover their funds.

The ED launched an investigation after complaints from hundreds of victims who had collectively lost crores of rupees.  For the more information click on this link

For the more information click on this link

ED’s Investigation: Tracking the Money Trail

The Enforcement Directorate initiated its probe after receiving inputs from:

✅ The Financial Intelligence Unit (FIU), which flagged suspicious financial transactions.

✅ The Reserve Bank of India (RBI), which warned about unauthorized forex trading platforms.

✅ Victims who filed complaints, reporting that their funds were locked without explanation.

1. Seizure of ₹170 Crore in Bank Deposits

The ED has frozen bank accounts linked to the operators of the fraudulent forex platform, seizing ₹170 crore in deposits from multiple banks. These funds were held under various shell companies and fake individual accounts used to launder money.

📌 ED’s Statement:

“Our investigation has uncovered a well-coordinated scheme where investors’ funds were illegally transferred abroad. The ₹170 crore seizure is a crucial step in dismantling this fraud.”

2. Overseas Money Transfers and Crypto Transactions

The probe also revealed that:

🔹 A significant portion of investor funds was sent to offshore accounts in Dubai, Singapore, and Hong Kong.

🔹 Some funds were converted into cryptocurrencies to make tracing difficult.

🔹 Shell companies were created to layer transactions and avoid detection.

3. Raids and Arrests

The ED conducted raids across multiple locations, including:

📍 Mumbai

📍 Delhi

📍 Hyderabad

📍 Bengaluru

📍 Chennai

Several company directors, financial intermediaries, and digital marketing promoters of the scam were detained for questioning.

How the Scam Exploited Loopholes in Forex Trading Regulations

In India, forex trading is highly regulated, and only platforms approved by RBI and SEBI are legally allowed to operate. However, fraudulent forex trading platforms exploit loopholes, including:

🔸 Operating through offshore websites that do not fall under Indian regulatory jurisdiction.

🔸 Using cryptocurrency exchanges to avoid detection of money movements.

🔸 Advertising on social media and private WhatsApp groups, bypassing official scrutiny.

🔸 Convincing investors to use foreign brokers, making it harder for Indian authorities to intervene.

📍 RBI Warning on Illegal Forex Trading

The Reserve Bank of India (RBI) has repeatedly warned Indian investors against trading on unregulated forex platforms, stating that:

“Retail investors should avoid unauthorized forex trading apps and websites, ED Seizes ₹170 Crore Bank Deposits as they may be scams.”

Despite these warnings, lack of awareness among retail investors has made them easy targets for fraudsters.

Impact on Investors: Thousands Left Financially Ruined

The crackdown by the ED comes too late for many investors, who have already lost their life savings.

📌 Victims Speak Out

Ravi Sharma, a victim from Bengaluru, shared his experience:

“I invested ₹5 lakh after seeing ads on Instagram. For a few months, ED Seizes ₹170 Crore Bank Deposits I got small returns, but then my account was frozen. I realized it was a scam when all my contacts also lost their money.”

Priya Mehta from Mumbai said:

“They made it seem so professional, with live trading dashboards and fake testimonials. ED Seizes ₹170 Crore Bank Deposits I invested my savings of ₹10 lakh, hoping to grow my money, but now it’s all gone.”

The psychological and financial impact on victims has been severe, ED Seizes ₹170 Crore Bank Deposits with many now struggling to repay debts taken to invest in the scam.

What’s Next? The ED’s Plan to Tackle Forex Scams

The Enforcement Directorate, along with SEBI and RBI, has outlined a multi-pronged strategy to prevent future forex trading frauds:  For the more information click on this link

For the more information click on this link

✅ Crackdown on Unregulated Trading Platforms – Authorities are working to block fraudulent forex websites and social media promotions.

✅ Tighter Oversight on Money Transfers – Banks and digital payment services are being instructed to flag suspicious transactions linked to forex trading.

✅ Legal Action Against Scam Operators – Prosecution and asset recovery efforts are being intensified to compensate victims.

✅ Investor Awareness Campaigns – The government will launch education initiatives to warn retail investors about forex trading risks.

📍 Statement from the Finance Ministry:

“We are committed to protecting investors from financial frauds. Those engaging in illegal forex trading will face strict legal action.”

Lessons for Indian Investors: How to Avoid Forex Trading Scams

To stay safe from fraudulent forex trading platforms, investors should follow these guidelines:

🔴 1. Verify Broker Legitimacy – Only trade with SEBI-registered and RBI-approved forex platforms.

🔴 2. Avoid “Guaranteed Profit” Schemes – No trading platform can guarantee fixed returns; such claims are red flags.

🔴 3. Check Website and App Authenticity – Avoid platforms that operate without clear regulation and transparency.

🔴 4. Never Invest Without Research – Always verify company credentials before investing.

🔴 5. Be Cautious of MLM and Referral Schemes – If a platform rewards you for bringing in new investors, it’s likely a Ponzi scheme.

Conclusion: A Major Blow to Financial Scams

The ED’s ₹170 crore seizure in this forex trading fraud probe marks a significant victory against illegal financial operations in India. However, ED Seizes ₹170 Crore Bank Deposits many such scams continue to thrive, exploiting the growing demand for high-return investments.

📌 Key Takeaways:

✅ The fraudulent forex platform trapped investors with false promises of high returns.

✅ The ED’s probe exposed money laundering through shell companies and crypto exchanges.

✅ Victims lost crores of rupees, highlighting the need for stronger financial awareness.

✅ The government is tightening regulations to prevent future forex scams.

As India’s financial markets grow, ED Seizes ₹170 Crore Bank Deposits investor protection and regulatory vigilance will be critical in stopping financial frauds before they cause widespread damage. ALSO READ:- U.S. Plane Carrying 119 Deportees Likely to Land in Amritsar on February 15: A Growing Challenge for India 2025

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?