Income Tax Portal Fixed; July 31 Deadline Likely to Stay:-

Income Tax Portal Fixed , The Income Tax (I-T) department has announced that the technical glitches in its e-filing portal have been resolved, ensuring that taxpayers can file their returns smoothly. This development comes as a relief to many taxpayers who were grappling with issues while trying to submit their tax returns before the July 31 deadline. Income Tax Portal Fixed Despite earlier concerns that the deadline might be extended due to these technical problems, it is now expected to remain unchanged.

Background

The new I-T e-filing portal, launched in June 2021, aimed to simplify the tax filing process and enhance the overall user experience. However, from the onset, the portal faced several issues, including difficulties in login, slow processing, and errors in data retrieval Income Tax Portal Fixed. These problems led to widespread frustration among taxpayers and professionals, prompting the Finance Ministry to take swift action to address the issues.

Resolution of Technical Glitches

In a recent statement, the I-T department confirmed that the major technical issues plaguing the portal have been fixed. This resolution was achieved through a series of updates and patches implemented by the portal’s developers. The department emphasized that the portal is now fully functional and ready to handle the anticipated surge in traffic as the deadline approaches.  for more information click on this link

for more information click on this link

Key improvements made to the portal include:

- Enhanced Server Capacity: The server capacity has been significantly increased to handle higher traffic volumes without causing slowdowns or crashes.

- Streamlined User Interface: The user interface has been optimized to make navigation more intuitive and user-friendly.

- Bug Fixes: Numerous bugs that were causing errors in data entry and processing have been fixed, ensuring more accurate and efficient operations.

- Improved Security Measures: Enhanced security protocols have been implemented to protect users’ data and ensure the integrity of the filing process.

Government’s Assurance

The government has assured taxpayers that all efforts have been made to ensure a seamless experience on the I-T portal. The Finance Ministry, in coordination with Infosys, the portal’s developer, has been working round the clock to address the issues. Income Tax Portal Fixed Regular updates and feedback from users have been instrumental in identifying and rectifying the problems promptly.

Finance Minister Nirmala Sitharaman, in a recent press conference, stated, “We understand the frustration and inconvenience caused to taxpayers due to the initial glitches in the portal. However, we are confident that the issues have been resolved, and taxpayers can now file their returns without any further difficulties.”  for more information click on this link

for more information click on this link

Industry Response

The resolution of the portal’s issues has been welcomed by the industry, particularly tax professionals and chartered accountants who play a crucial role in assisting taxpayers with their filings. Many professionals had raised concerns about the feasibility of meeting the July 31 deadline given the initial problems with the portal.

Naveen Wadhwa, DGM at Taxmann, a leading publisher on tax and corporate laws, commented, “The timely resolution of the technical issues is a significant relief for both taxpayers and professionals. The improvements to the portal will certainly help in ensuring that the filing process is smooth and efficient. Income Tax Portal Fixed We appreciate the efforts made by the I-T department and Infosys in addressing the concerns.”

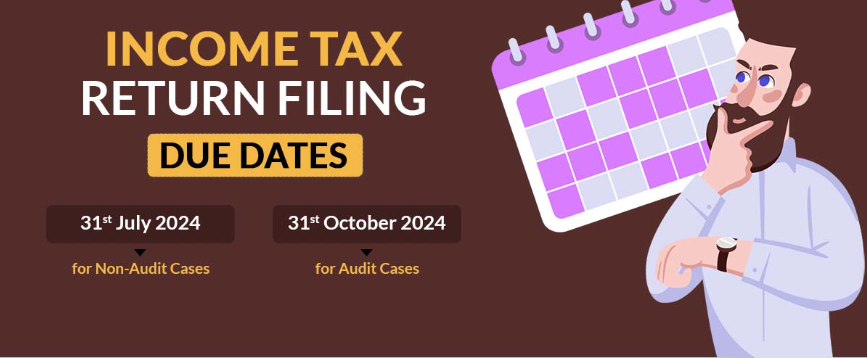

Implications of the July 31 Deadline

With the portal now functioning optimally, it is unlikely that the July 31 deadline for filing income tax returns will be extended. Income Tax Portal Fixed This means taxpayers need to act quickly to complete their filings to avoid penalties and interest charges.

For Individual Taxpayers:

- The deadline applies to all individuals who do not require an audit, which includes salaried employees, self-employed individuals, and professionals.

- Failure to file by the deadline can result in a late filing fee under Section 234F of the Income Tax Act, along with interest on any outstanding tax liability.

for more information click on this link

for more information click on this link

For Businesses and Other Entities:

- Businesses and other entities whose accounts do not require an audit also need to adhere to the July 31 deadline.

- Entities that do require an audit have a later deadline, typically September 30, giving them additional time to finalize their accounts and file returns.

Steps to Ensure Timely Filing

Given the tight timeline, it is crucial for taxpayers to take proactive steps to ensure they meet the deadline. Here are some key steps to consider:

- Gather Necessary Documents: Ensure all relevant documents such as Form 16, interest certificates, and investment proofs are ready.

- Verify Information: Double-check all information entered into the portal for accuracy to avoid errors and potential delays.

- Utilize Online Resources: Leverage online resources, including tutorials and help guides available on the I-T portal, to navigate the filing process.

- Seek Professional Help: If unsure about any aspect of the filing process, consider seeking assistance from a chartered accountant or tax professional. Future Improvements and Expectations

While the immediate issues with the I-T portal have been addressed, there are ongoing efforts to further enhance the system. The I-T department and Infosys have committed to continuous improvements based on user feedback to ensure that the portal remains reliable and user-friendly.

Taxpayers can expect the following future enhancements:

- Ongoing Technical Support: Continued technical support to promptly address any new issues that may arise.

- User Feedback Mechanism: A robust feedback mechanism to capture user experiences and suggestions for further improvements.

- Regular Updates: Periodic updates to incorporate new features and enhancements based on evolving tax laws and user needs.

Conclusion

The Income Tax Portal Fixed resolution of technical glitches in the I-T e-filing portal is a welcome development, ensuring that taxpayers can file their returns smoothly before the July 31 deadline. While the initial problems caused significant inconvenience, the swift action by the Finance Ministry and Infosys has restored confidence in the system.

With the deadline likely to remain unchanged, taxpayers must act promptly to complete their filings. The improvements to the portal are expected to facilitate a more efficient and user-friendly filing experience, Income Tax Portal Fixed helping to streamline the tax compliance process in India.

As the I-T department continues to enhance the portal, taxpayers can look forward to a more robust and reliable system in the future, supporting the government’s broader goal of digitizing and simplifying tax administration. ALSO READ:- Indian Challenge in Other Sports: Overcoming Obstacles and Achieving Success 2024